Reflecting on 2024

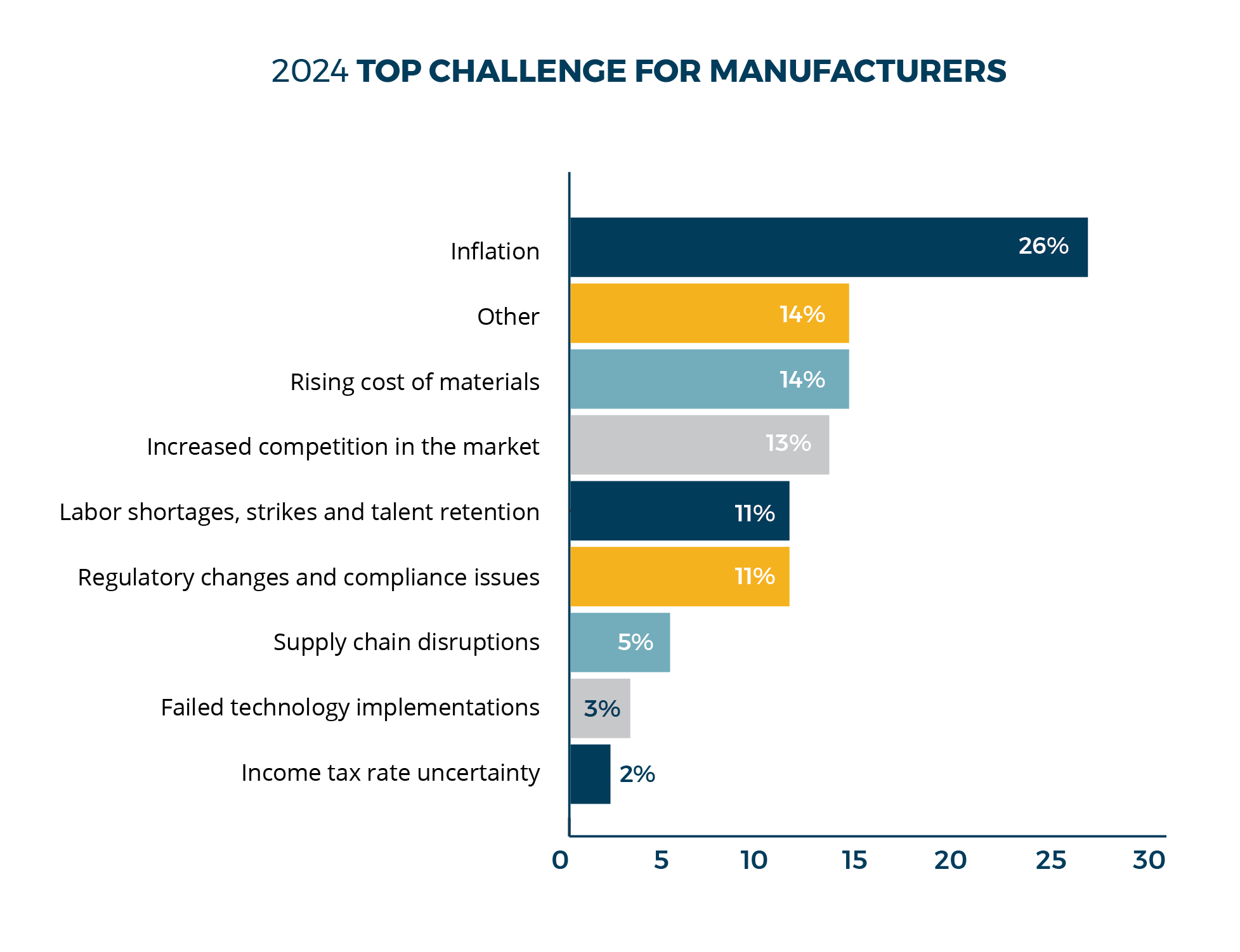

In Sikich’s February 2024 Pulse, only 8% of manufacturing executives selected inflation as their top challenge for the year ahead and a majority (31%) said labor shortages. However, in our most recent survey, 26% of manufacturing executives said inflation was their top challenge in 2024, while only 11% said labor shortages. Of the two options, what actually caused manufacturers greater difficulties differed from executives’ predictions at the start of 2024. The U.S. Department of Labor reported that in January 2024, the consumer price index increased just 0.3% — so for those monitoring this data, it’s reasonable to assume their predictions weren’t inaccurate at the time of Sikich’s survey.

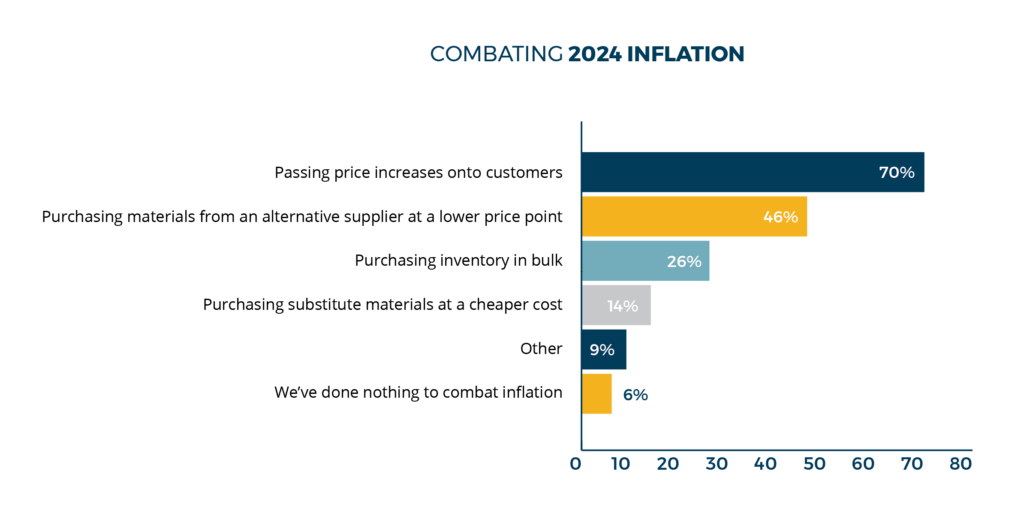

Executives were asked how they combatted inflation in 2024, with seven out of 10 manufacturers saying they passed price increases onto their customers.

Manufacturing companies have had to be agile in combating rising inflation with the shortage of labor. Passing rising costs onto customers while maintaining customer loyalty has forced manufacturers to find other ways to provide value. Many have optimized automation to reduce dependency on labor and have worked to upskill existing employees to mitigate workforce gaps. Further, manufacturing leaders have started to diversify their supplier base and negotiate better terms to overcome challenges posed by rising inflation.

Jerry Murphy, CPA, CMA, CGMA

Principal & Manufacturing Services Leader

Webinar: 2025 Economic Update for Manufacturers

Michael Weidokal is an internationally recognized economic and geopolitical forecaster who helps business leaders, policymakers, and the wider public understand issues and trends that impact the world today and those that will shape the world in years to come.

Join Sikich and Michael on March 26 for our 2025 Economic Update for Manufacturers webinar.

REGISTER >>

New Year, New Obstacles – 2025 Outlook

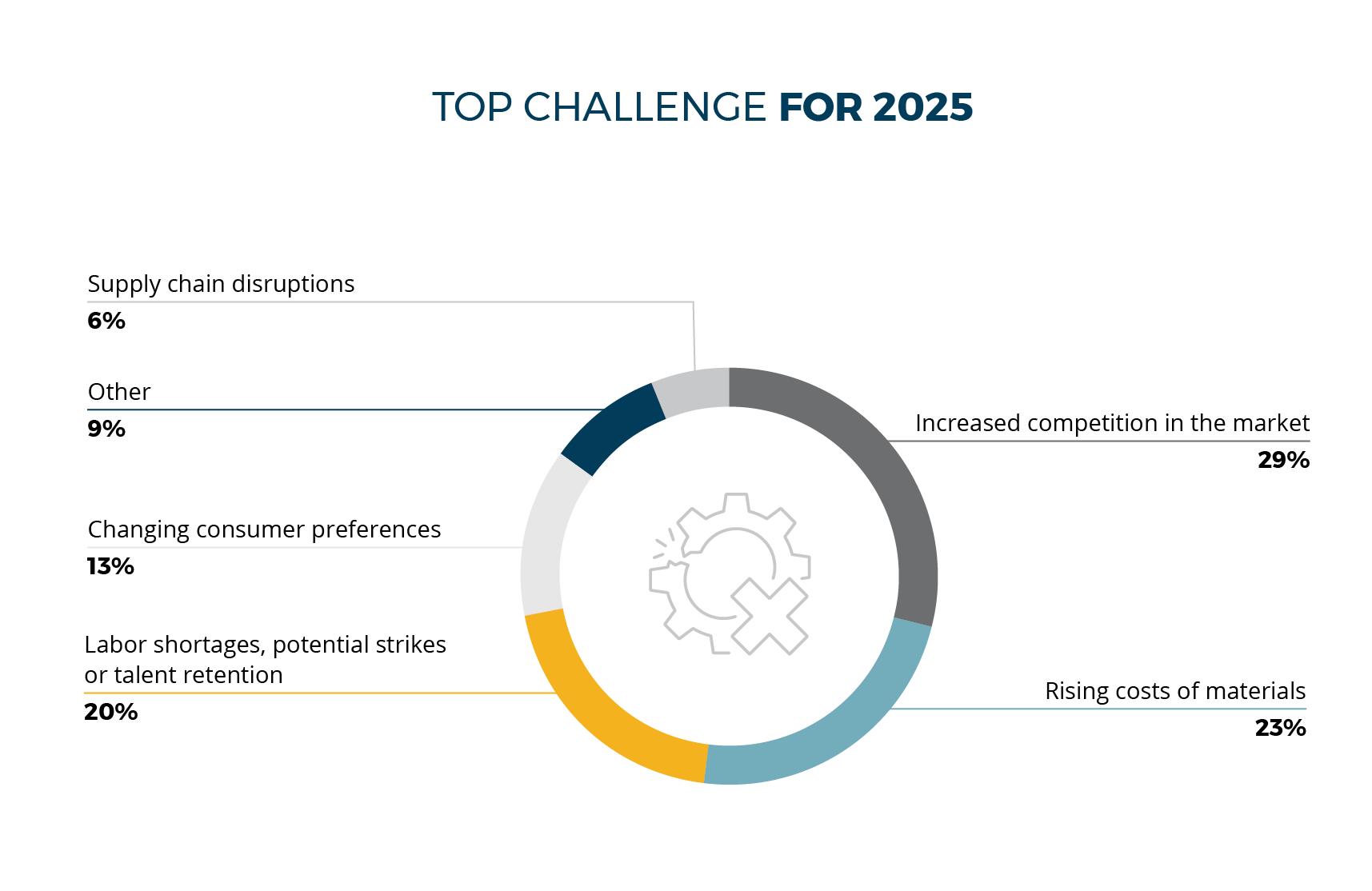

In November, manufacturing executives were asked which challenge represented the greatest obstacle to their business for 2025. Twenty-nine percent said increased competition in the market was their greatest challenge in the year ahead – a significant uptick from the February 2024 survey results, which showed only 9% selecting increased competition as the top challenge in the year ahead. Further, survey findings showed challenges around the rising cost of materials more than doubled from 11% for 2024’s outlook to 23% for 2025’s outlook.

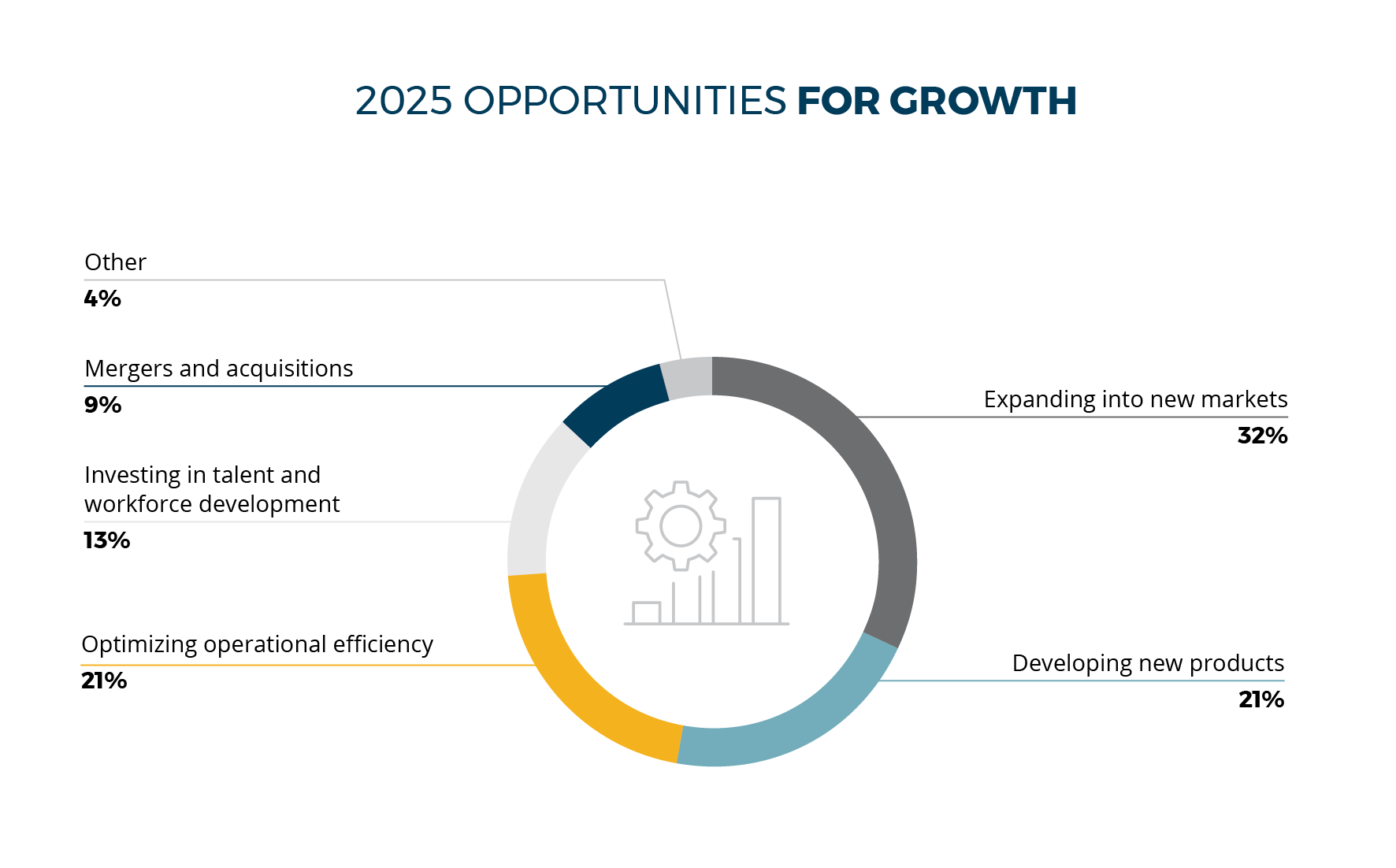

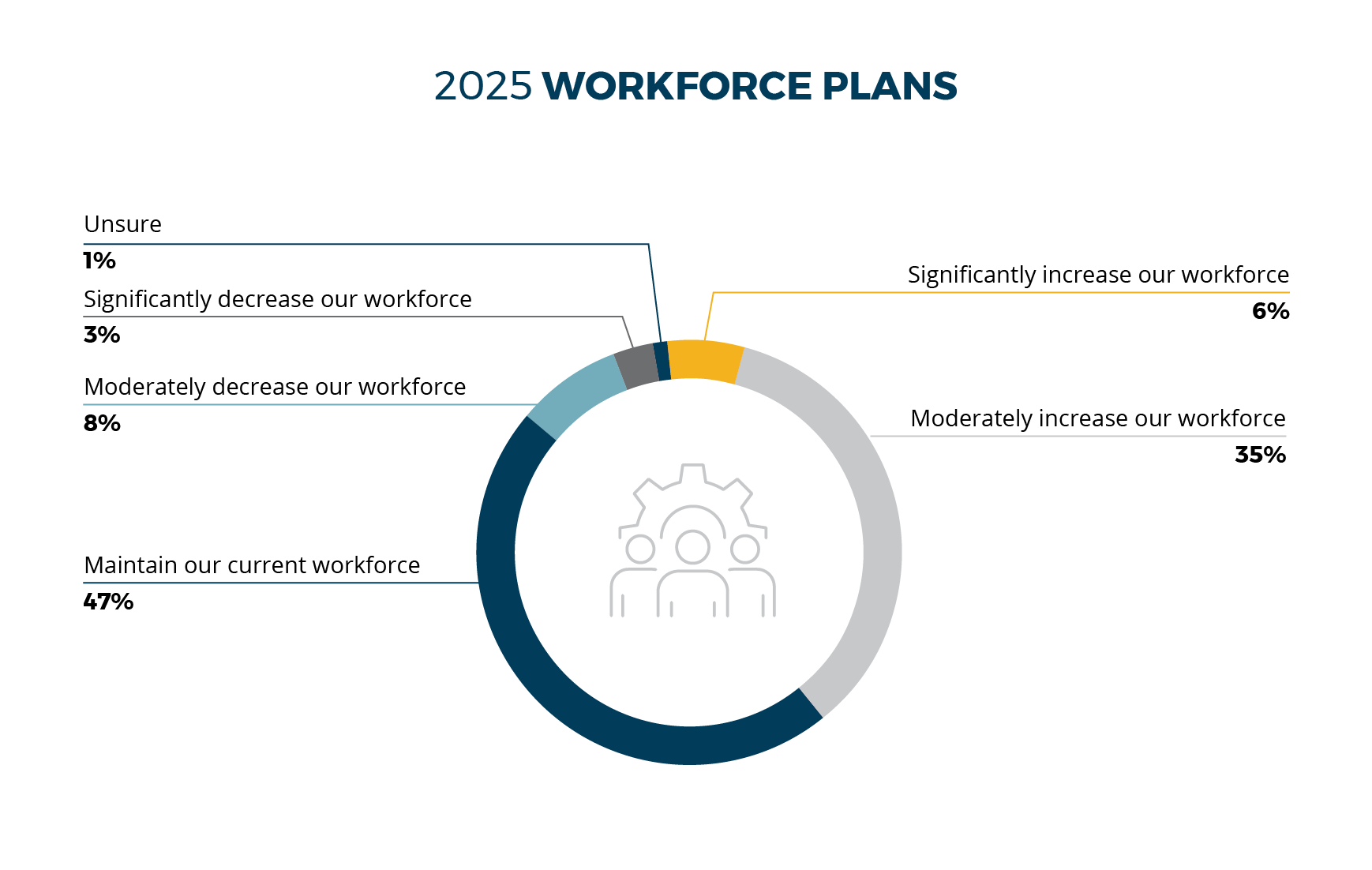

With new challenges also come new opportunities for growth in 2025. Thirty-two percent of executives saw expanding into new markets as their top area for growth, and 21% are focused on new product development. These plans for growth also impact headcount decisions, as 41% of executives plan to increase headcount in the next six months.

Fraud Prevention

According to the Association of Certified Fraud Examiners’ (ACFE) “Occupational Fraud 2024: A Report to the Nations,” which studied 1,921 fraud cases around the world, it is estimated that organizations lose 5% of revenue to fraud each year. In the study, the manufacturing industry had the second most fraud cases behind banking and financial services – the median loss in these cases was over $200,000.

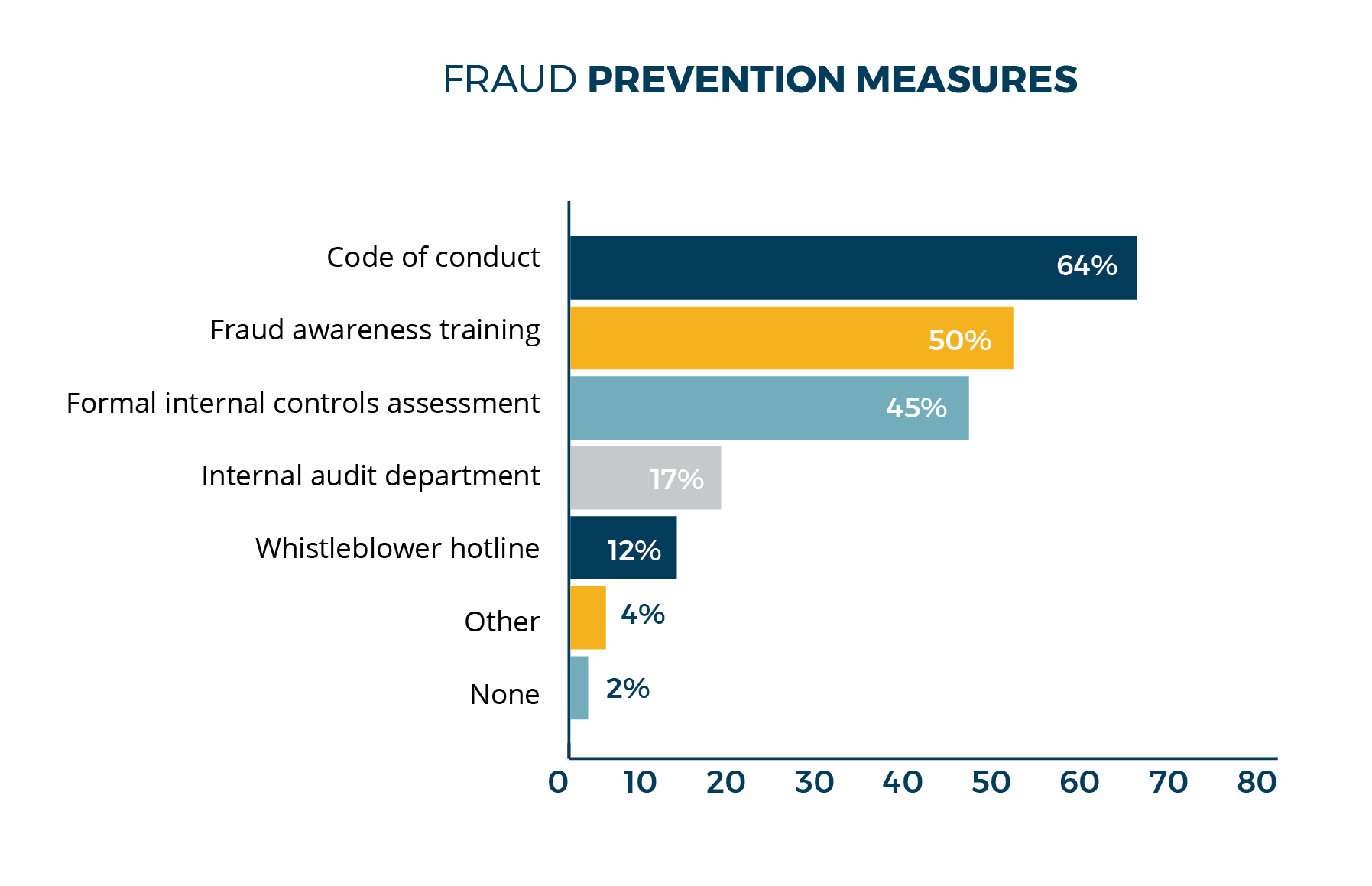

We asked manufacturing executives about current fraud prevention measures at their business and confidence in the controls’ ability to recognize and identify fraud. Eighty-six percent of respondents were at least somewhat confident in their internal control environment’s ability to identify fraud, while only 17% of respondents said they have an internal audit department. Among respondents, 16% of them only have a code of conduct as internal controls.

“There are no industries or companies immune to fraud, and manufacturing, in fact, is one of the most susceptible. While executives’ confidence remains positive, fraud is happening at a higher rate today than we’ve historically seen. Executives should critically evaluate their internal controls to ensure their business is protected from threats both internally and externally. The investment in internal controls is minimal when compared to the many thousands of dollars that could be lost to fraud.

Steve Randall, MBA

Principal, Risk Practice Lead

About Sikich

Sikich is a global company specializing in technology-enabled professional services. With more than 1,900 employees, Sikich draws on a diverse portfolio of technology solutions to deliver transformative digital strategies and ranks as one of the largest CPA firms in the United States. From corporations and not-for-profits to state and local governments, Sikich clients utilize a broad spectrum of services* and products to help them improve performance and achieve long-term, strategic goals.

*Securities offered through Sikich Corporate Finance LLC, member FINRA/SIPC. Investment advisory services offered through Sikich Financial, an SEC Registered Investment Advisor.