This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Is Your ERP Making All the Right Plays?

Is your ERP system running as smoothly as the Philadelphia Eagles’ run to the Big Game or does it miss a crucial catch like Tom Brady? Your legacy, on-premise ERP system may be working fine, but your business deserves a system that will go the extra yards, score that touchdown, and continue to do so in the future no matter how much your business fluctuates and grows.

What is a Legacy System?

A legacy system refers to an older computer system or software that has been rendered outdated by recent or upgraded versions. Most of the time, these legacy systems work just fine. However, they no longer have upgrades available to them, which means that if the company changes or grows, the system can’t change or grow along with it.

For this reason, many businesses are switching to cloud-based ERP. With ERP in the cloud, upgrades happen immediately and without the extra licensing costs. There’s no need to purchase a new upgraded version. There’s only one install to purchase and implement and then that’s it as far as upgrades go.

Is Your Legacy ERP Solution Following a Championship-winning Playbook?

Your business may be running just fine on your legacy system. Or maybe your finance department believes you can’t afford such an upgrade at the moment. If that’s the case, the better question to ask is if your business can afford to not upgrade. By not upgrading, your business will lose any and all competitive edge.

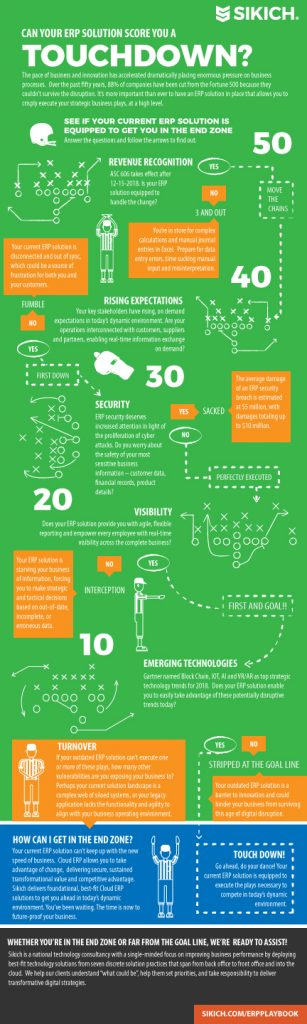

Even if you’re dead set right now on keeping your legacy ERP system, run through this playbook infographic below and see if your solution is racking up the big score.

Key components of the ERP Playbook include the following:

- Embracing the digital transformation;

- Empowering customers with a self-serve portal;

- Seamlessly connecting companies to all parts of their operations;

- Prepping for ASC 606;

- Preventing cyber attacks and security breaches; and

- Taking advantage of emerging technologies.

Does your current ERP solution have all of these successful plays in its playbook? Is your playbook future-proof for whatever the opposing team tosses your way? Perhaps it’s time to evaluate a new ERP solution with more winning plays. Contact us today to build your own winning ERP playbook and get you to the end zone.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.