The COVID-19 pandemic flipped traditional business operations upside down, uncovering what companies need to do not only to survive, but to thrive. Presented with inevitable circumstances, it’s important to place a different lens on the current situation as you continue to navigate today’s deal market.

We recently spoke with a panel of experts from Marsh and Sikich to discuss their outlook on M&A activity for the remainder of the year and into 2021, while also delving into the benefits of reps and warranties, the role Quality of Earnings reports play during these times and why IT due diligence should never be overlooked in any transactions.

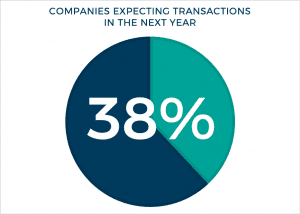

The majority of participants on the line shared their positive outlook for the M&A landscape, with 38 percent of attendees predicting to take part in two to four transactions over the next 12 months and 31 percent optimistically predicting involvement in four to nine transactions.

Below are highlights gathered from our panel of experts on M&A trends and considerations during the pandemic:

Quarterly Predictions for M&A Space

Now that the initial strain from the pandemic is behind us, we’ve seen many businesses flourishing even with economic turbulence. Deals are happening again. M&A activity is moving forward at an optimistic rate. Nonetheless, the reality is that the international supply chain is interrupted, and we cannot predict when it will return to business as usual. Further, a lack of in-person and on-site occurrences are deterring some buyers from purchasing physical assets. The year started off positively, but we cannot ignore that many organizations took a hit in the second and third quarters. As private equity firms swiftly enter back into regular deal-making, we expect the fourth quarter and early 2021 to offer opportunities for buyers to acquire distressed assets, as transaction players rejoin the market with more confidence and government funding discontinues.

Protect Your Company During Acquisitions When Facing Uncertainty

We’ve seen a number of businesses conducting M&A activity per usual during this time; however, more often than not, companies are facing some level of unprecedented obstacles. For those dealing with the challenges resulting from the pandemic, we encourage you to explore the following strategies.

Roll-ups

Many organizations are taking part in roll-ups, where smaller companies in the same industry sell the businesses as one, larger organization to private equity firms. This not only benefits the sellers, but buyers are provided more resources, personnel and customers through this larger opportunity.

Defer Payments

Further, buyers and sellers are setting up payment deferral plans, in which buyers pay a portion of the costs to purchase a company and then pay in installments post-close. Buyers can also acquire a certain percentage of a target company—versus the entire business—with the option to acquire the remaining amount of the organization at a later date when they are more financially sound.

R&W Insurance

We all know that a sense of security and certainty when executing a transaction is at a premium—especially when considering our current economic predicament. R&Ws are also crucial steps to take to reduce transactional risk and find clarity in an uncertain world.

R&Ws are an insurance product that covers the unknown risks of an M&A transaction. Certain issues can arise post-close that weren’t apparent at the onset of the deal—whether related to bookkeeping or concerns about employees. This insurance is designed to cover the risk of loss that occurs out of a seller’s breach of representation.

Quality of Earnings Report

Another option increasing in popularity is a Quality of Earnings Report, which determines the long-term earning potential and true cash flow of the company to be acquired. These reports calculate a realistic projection of a company’s revenue and excludes nonrecurring costs or earnings. While a business may have taken a hit during the pandemic, if they typically perform well, a buyer can expect their future sales to also be successful.

During the due diligence process, be sure to consider these ideas to guarantee the best outcome you can devise.

Don’t Overlook IT Due Diligence

Phishing scams and cyber-attacks have unfortunately been on a rise since the onset of the pandemic. Many employees transitioned to a remote work environment, where their technology or cybersecurity protocols were limited.

As you look to acquire an organization, you’ll need to fully examine the target company’s IT systems and technology processes. Determine:

- Have they experienced a breach previously?

- Do they use up-to-date technology programs?

- Is their information secure and protected?

- Is the current team in place the right team to manage the IT environment and protect your data?

Further, look at the company’s IT budget, the technology they currently have in place as well as their procedures, users, archived information and available data. When you acquire an organization, you also acquire all of the skeletons in their closet, so it’s important to analyze any IT or cybersecurity risks the company has or currently had.

The deal-making landscape has drastically changed over the past few months. Our team is here to support you and your business through the rocky waters of M&A transactions. Contact us to talk about your unique situation.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.