This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Updated PPP Loan Forgiveness Application Forms: Impact on Not-for-Profit Organizations

On June 5, 2020, the President signed H.R. 7020, “The Paycheck Protection Program Flexibility Act of 2020” (“PPPFA”) into law, putting several tax efficient regulations into effect for not-for-profit and higher education organizations.

Key Features of the PPPFA

This legislation extends the PPP loan forgiveness covered period from eight weeks to 24, with the period running from the date the loan was originated. Please note that employee compensation limits still apply, and forgiveness will continue to max out at $100,000 for annual salary. The bill also defers the date a borrower can have Full-Time Equivalents (FTEs) and employee compensation at the same threshold as the borrower had on February 15, 2020 (from the date of June 30 through December 31, 2020). If a borrower gets their payroll back to this level, the PPP loan forgiveness will not be reduced.

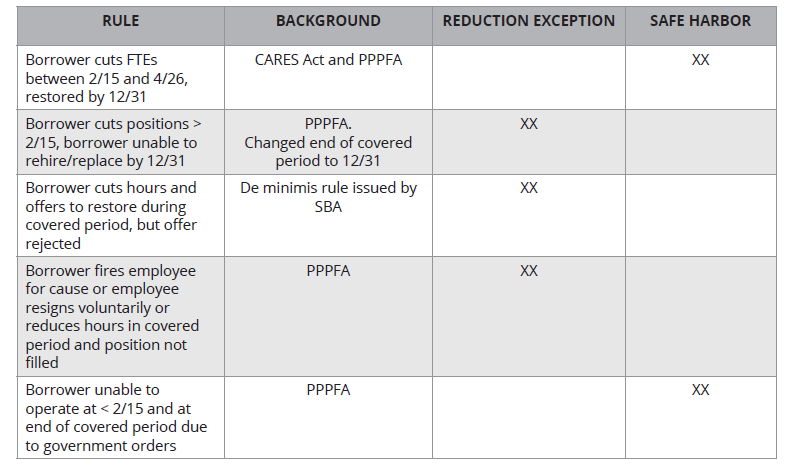

Further, there in an exception to the “Reduction Exception” of safe harbors, which considers a vacant position as if it is filled. There is also a safe harbor that automatically sets the FTE ratio at 100 percent.

A summary of FTE special rules:

The FTE special rules replace the “75/25 rule” introduced by the SBA with a “60/40 rule” (60 percent for payroll costs and 40 percent for non-payroll costs). These other costs can account for a higher portion, but this is likely less of a concern due to the longer 24-week covered period.

The SBA and Treasury indicated, after the PPPFA was signed, that if a business missed this 60 percent threshold, it could still receive partial forgiveness on its PPP loan.

Another favorable change in the PPPFA provides that the PPP loan forgiveness will not be reduced as a result of a decline in FTEs if the borrower is able to show one of the following two situations apply:

- An inability to rehire individuals, who were employees of the borrower as of February 15, 2020, and the inability to hire similarly qualified employees for unfilled positions by December 31, 2020.

- An inability to return to the same level of business activity as the business was operating at prior to February 15, 2020, due to the borrower needing to comply with requirements established by the CDC or other government agencies. This exemption essentially states that by December 31, 2020, if a business is unable to open due to government orders, any drop in FTEs occurring from these restrictions will not be considered in determining a reduction in the loan forgiveness amount.

SBA Updates Loan Forgiveness Application Forms

On June 17, 2020, the SBA issued updates to its PPP Loan Forgiveness Application Form (Form 3508) based on changes made by the PPPFA. One of the latest SBA developments is the new EZ form (Form 3508EZ). A not-for-profit borrower can use the new Form 3508EZ if it meets one of the three provisions as stated in the SBA’s guidance.

Limitations on “Double Dipping”

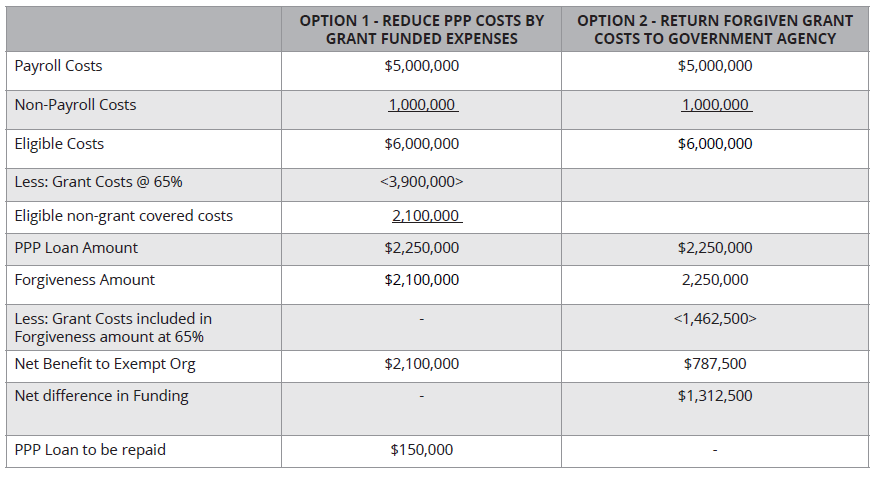

Exempt organizations should monitor if an expense is paid for by two sources. Any organization that works with government agencies (at the federal, state, or local levels) under a “cost-plus” or “cost reimbursement” arrangements are impacted by this rule. According to the OMB’s Memorandum (M-20-26, issued on June 18, 2020), any payroll costs paid for with PPP loans must also not be charged to current federal awards.

When PPP loans were applied for, most not-for-profit entities used their total payroll. With the rules against double dipping, exempt organizations will need to account for federal and state grant-covered expenses when they seek PPP loan forgiveness. The ultimate result is still uncertain, but there are likely two options to handle these situations.

To learn more about PPP loan forgiveness for not-for-profit entities, please contact us.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.