This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

What’s New in Salesforce Financial Services Cloud’s Spring 21 Release

Salesforce has continued to demonstrate an investment in the financial services industry over the past few years with its improvements to Financial Services Cloud features. Here’s a sneak peek into the top pieces of functionality coming in the Salesforce Financial Services Cloud (FSC) Spring 21 update, and how it can add value for you and your clients.

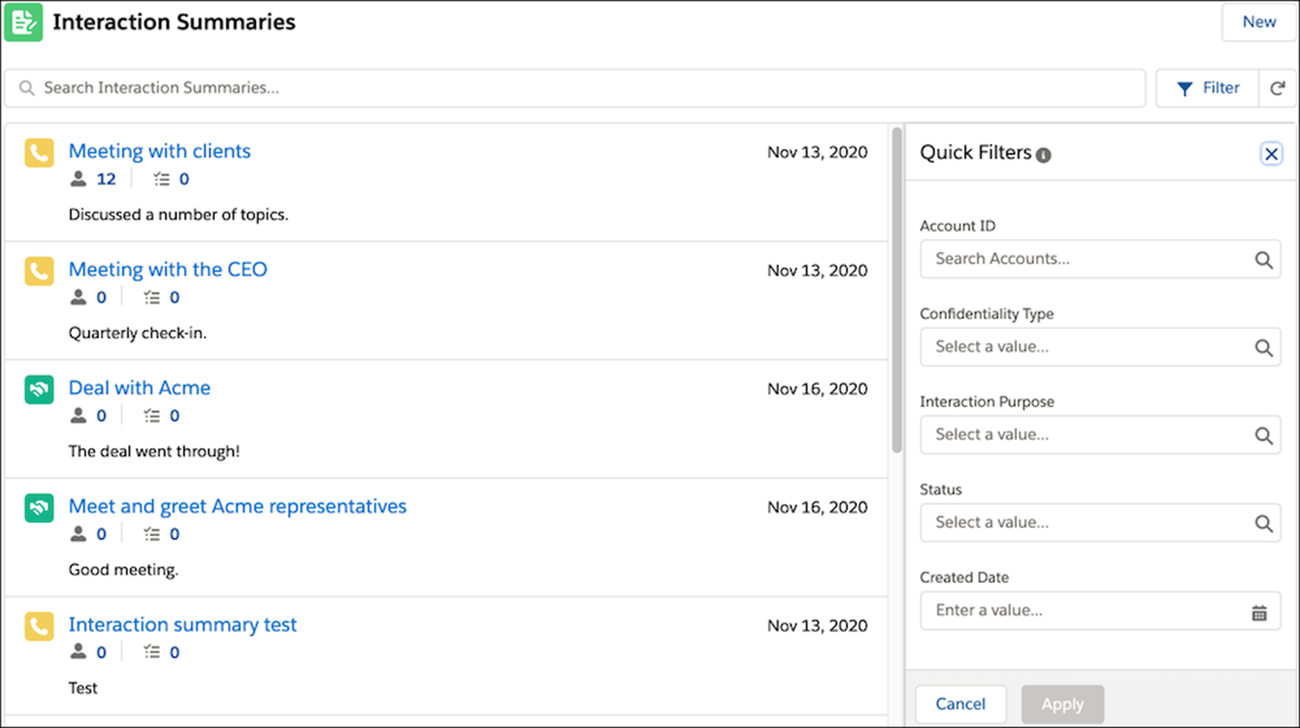

All: Interaction Summaries

Perhaps the most exciting feature of Spring 21 is the introduction of Interaction Summaries, which solve the long overdue issue of being able to reference a complete client history in preparation for or during an impromptu client meeting. While viewing an Account record, simply add the Interaction Summaries component and the valuable notes that have been recorded will be visible in one place. Additionally, you are able to control specific visibility of each interaction summary in order to keep relevant parties informed and meet compliance requirements.

All: Compliant Data Sharing

Salesforce has made it clear that regulatory requirements are a major focus with its FSC product roadmap, and Compliant Data Sharing is just another example of this. With Spring 21, users will be able to create Participant Groups for the appropriate sharing of information when the same individuals are commonly categorized as “need to know,” so that manual maintenance might be drastically reduced. Additionally, within the context of the new and improved relationship view, the Actionable Relationship Center (ARC), you will also be able to see the participants with record access.

Consumer Banking: Branch Management

Have you struggled in the past with aligning your users and clients to the appropriate business model? Are there known imperfections in your picture of branch performance? Enter FSC’s Branch Management functionality. Like other Salesforce resources such as Role Hierarchy or Territory Hierarchy, you will be able to define a Branch Hierarchy and assign the appropriate personnel in order to properly account for activities and performance associated with a branch, even when your HR/other hierarchies may be different. Users can also select the branch they are operating within, so any new activity within Salesforce is assigned appropriately to that branch.

Additional Noteworthy Changes

- Intelligent Form Reader will allow for the capture & entry of certain data points off of scans/PDFs of certain common forms

- Rollup performance has been enhanced, allowing for more streamlined calculations when aggregating information within a Household or elsewhere

- Life Event Insights allow you to more easily segment your clients for targeted campaigns such as 529 communications for those with a newborn child.

- More components that were previously only available for desktop have been optimized for mobile use as well.

If you would like to learn more about Salesforce Financial Services Cloud, please contact us today. We have a wide variety of experience across all verticals of the industry, and even have our own library of common extensions to Financial Services Cloud for streamlined implementation and leveraging of best practices.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.