This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Expense Deferral: Expertly Hidden in Microsoft Dynamics 365 Finance and Supply Chain Management Subscription Billing

In Microsoft Dynamics 365 for Finance and Supply Chain Management (D365 FSCM), we have always had a challenge with Prepaid expenses and how to amortize them over several periods. We have all tried using one or more of the following functions:

- Accrual schemes

- Periodic journals

- Voucher templates

- Fixed asset module amortization

None of these have been quite right in terms of creating an expense deferral schedule in D365 FSCM and posting the expense in the future periods.

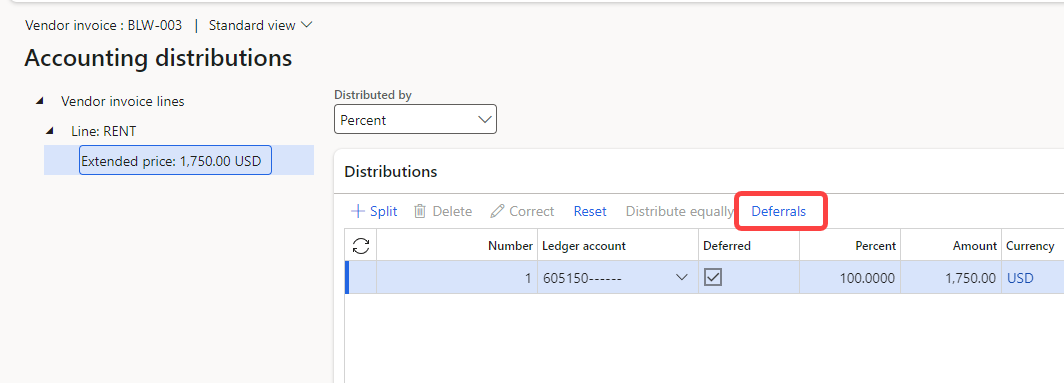

I was recently testing a Pending vendor invoice in D365 FSCM, and I noticed a cute little button within the Accounting distributions form labeled Deferrals.

I was intrigued. I had never noticed this button before.

It turns out this button is part of Revenue and Expense deferrals, which is part of Subscription Billing. But we don’t need Subscription Billing, right? Perhaps we need to explore it a bit more.

Expense Deferrals in D365 FSCM Subscription Billing

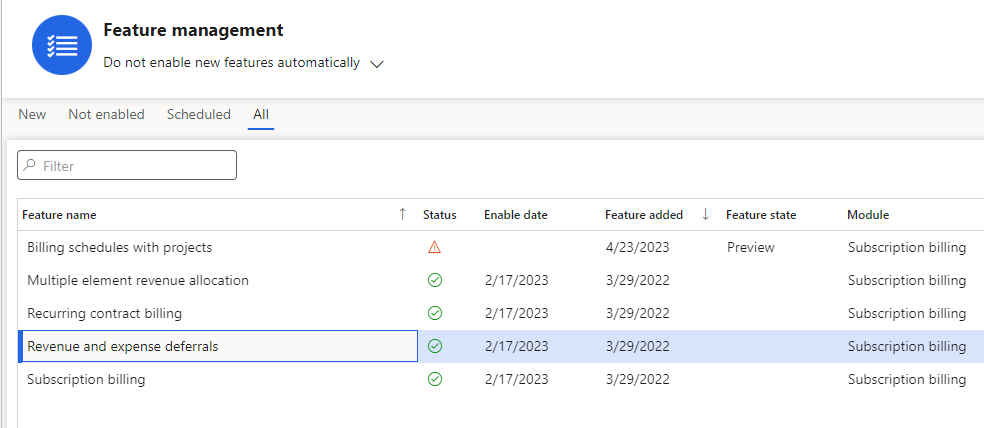

Once you have the Subscription Billing features enabled (which were released mid-2022), the Expense deferral functionality will be part of that.

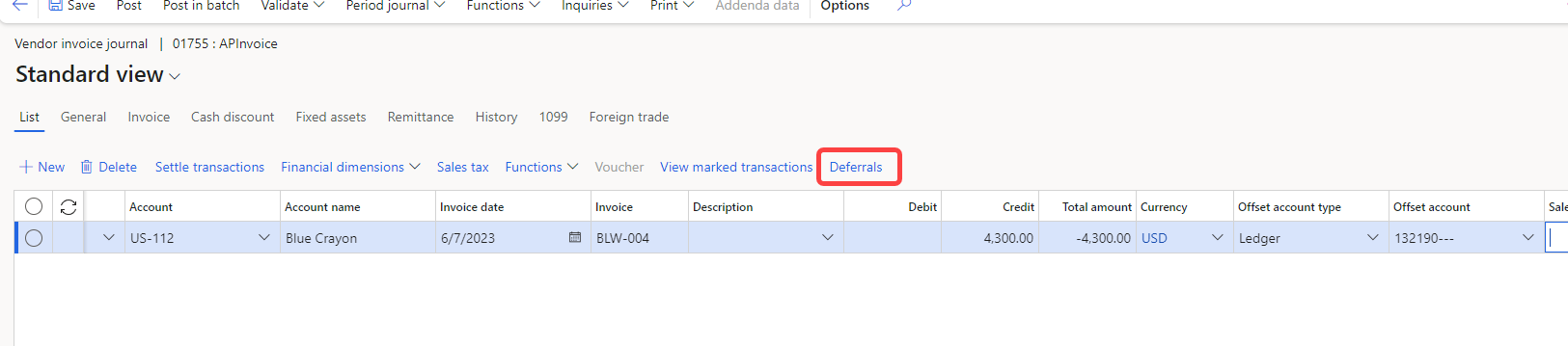

In addition to adding the Deferral button in the Pending vendor invoice accounting distributions form, it adds the same Deferral function to the AP Vendor invoice lines as well as the General journal lines forms.

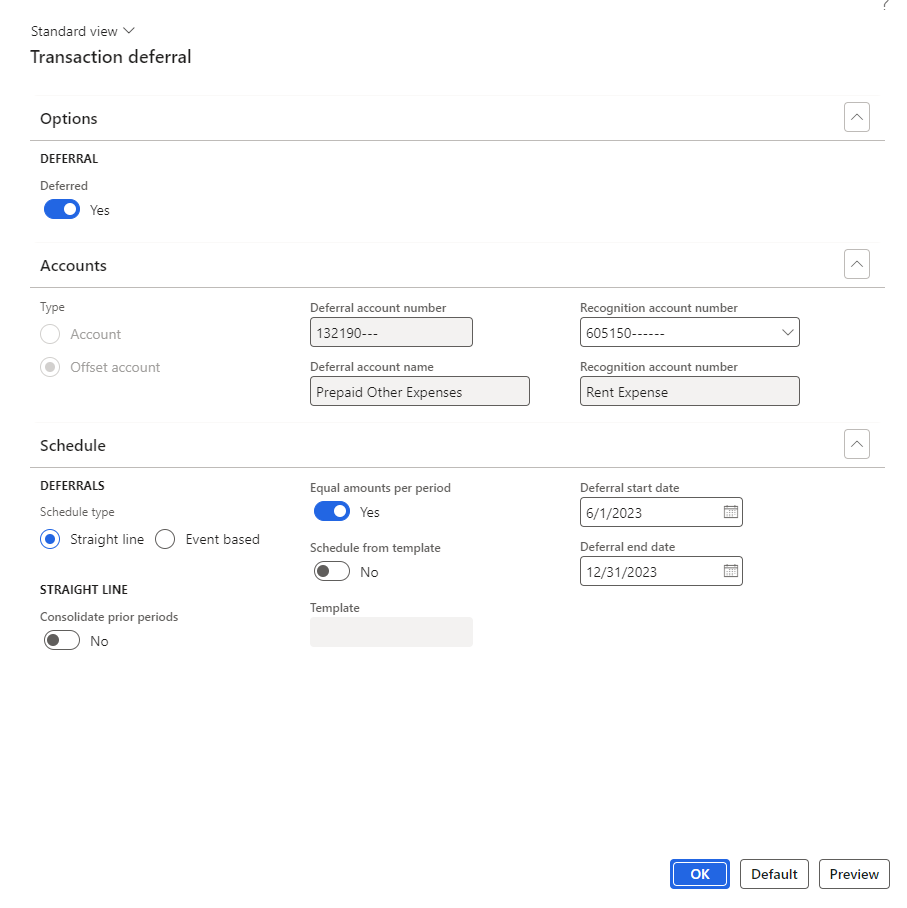

Within the deferrals form, you can set up the deferral schedule (or select a predefined template).

After posting the invoice journal, the deferral is added to the Deferral schedules in the Subscription Billing module.

When you are ready to post (recognize) the expense in those future periods, you run the Recognition processing Periodic task in the Subscription Billing module.

That creates a General journal that users can review and post.

I’m so excited about this new functionality. I’m going to start recommending that all clients enable Subscription Billing so they can use the expense deferrals in D365 FSCM.

Process Summary:

- Enable Subscription billing and the “Revenue and expense deferrals” features.

- Create a Pending vendor invoice, Vendor invoice journal, or General journal.

- Click the Deferrals button to create a Deferral schedule.

- Post the Invoice or Journal.

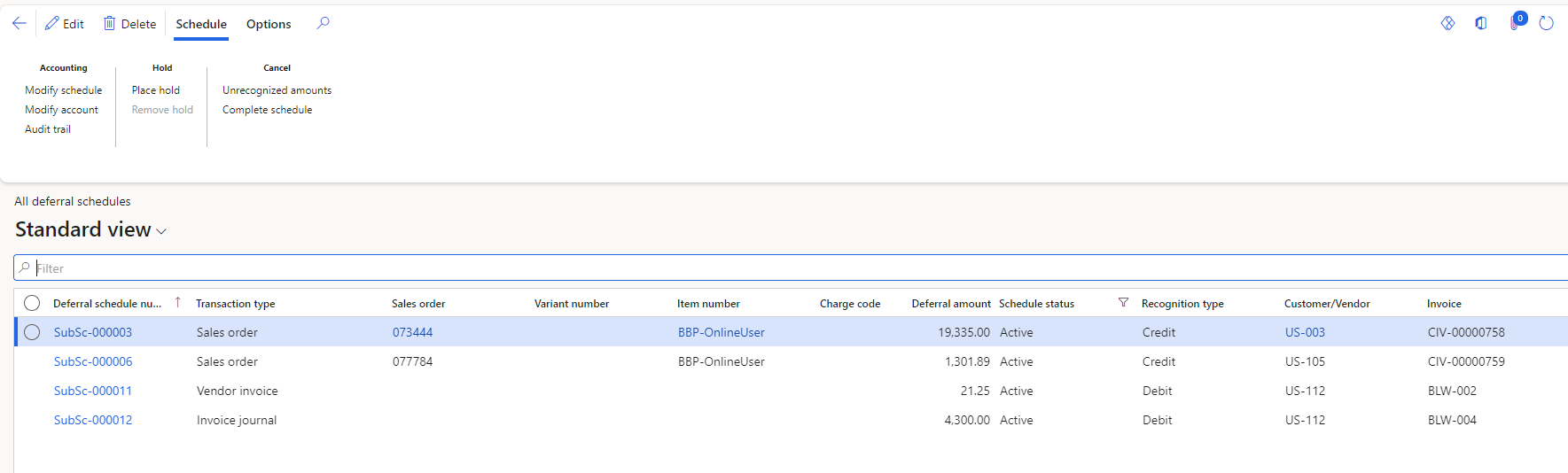

- Review Deferral schedules by navigating to Subscription billing > Revenue and expense deferrals > Deferral schedules > All deferral schedules.

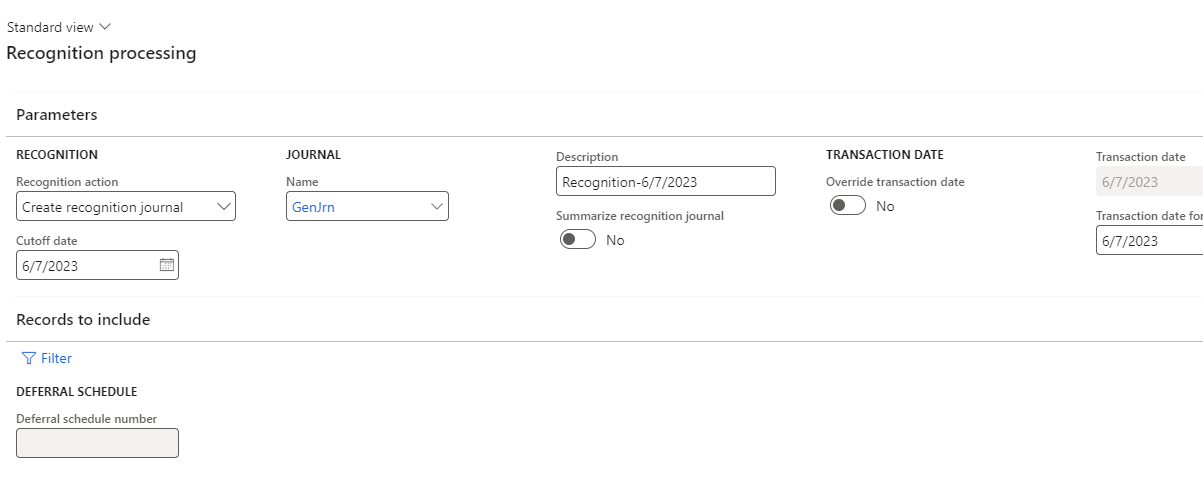

- In subsequent periods, post the deferred expense by navigating to Subscription billing > Revenue and expense deferrals > Periodic tasks > Recognition processing.

If you have specialized Revenue Recognition accounting, you should already be shifting that over to the Subscription billing module.

And coming soon:

- Billing schedules and deferrals with projects (in Preview as of this writing)

Learn more about the features on Microsoft’s Learn pages:

https://learn.microsoft.com/en-us/dynamics365/finance/accounts-receivable/sb-deferrals

Have any questions about expense deferrals in D365 for Finance and Supply Chain Management? Reach out to our experts at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.