Pre-Deal

Set the stage for the company you’re bringing to market:

- Secure operational wins by scouting for synergies that boost performance

- Proforma adjustments to maximize deal value

- Evaluate your game plan and scenario plan through proactive succession planning and net proceeds analysis

- Gain insight into what your businessis worth with valuations, including intangible assets and fair market value of common stock

- Enhance buyer confidence in accurate financial reporting, robust IT security and dependable compliance procedures

- Assistance with cleaning your financial records to the proper GAAP basis through detailed accounting services

Due Diligence

Sell-side diligence that scores points with potential buyers and delivers over $100 carry for every $1 invested.

Financial and Tax Due Diligence

- Prepare quality of earnings and roll forwards

- Calculate working capital analysis and strategy

- Formulate profitability analysis and strategy

- Manage and facilitate sell-side due diligence and data room support

- Provide tax modeling of options and structures

- Evaluate controllable risk

IT and Cybersecurity Due Diligence

- Assess if current systems will support the future business

- Ensure protective measures are in place so buyers aren’t acquiring a costly breach

- Identify compliance gaps and evaluate data protections and business continuity controls

Post Close

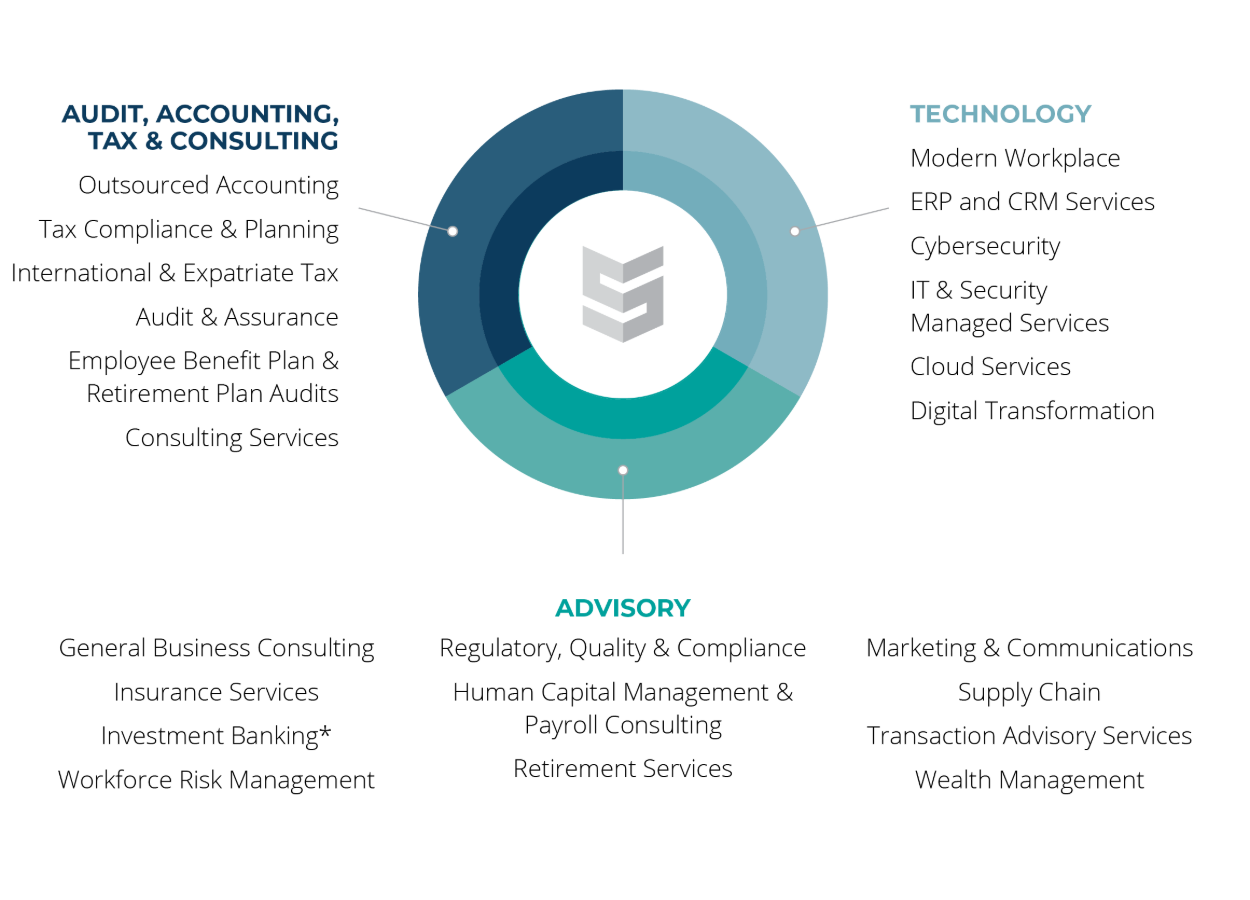

Our transaction advisory services bring together multiple disciplines to provide you cohesive recommendations and seamless service. Take a look at our suite of services.