This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

3D Printing: Tax Incentives for Manufacturers

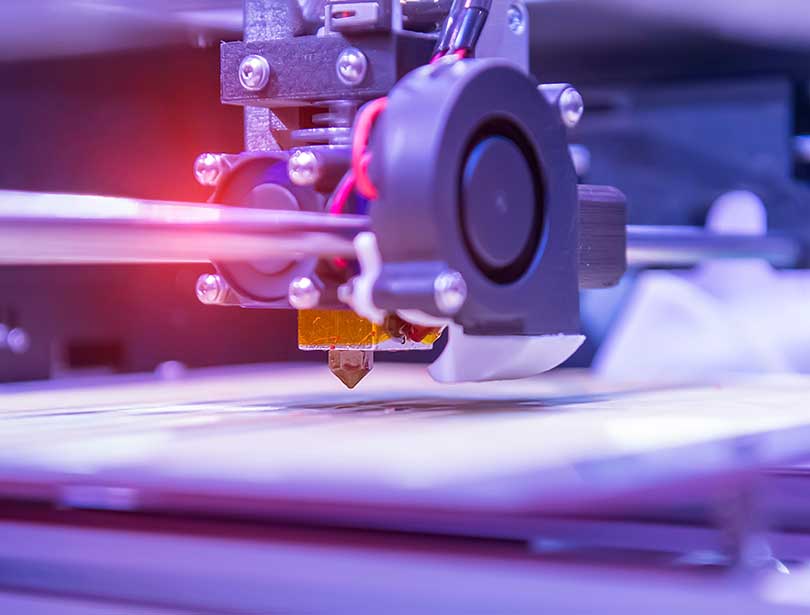

3D printing, also known as additive manufacturing, has evolved from niche applications to a vital tool in various sectors of the manufacturing industry, like consumer goods and aerospace engineering. This is because of the expansive advantages 3D printing offers in customization, rapid prototyping and low-volume production.

Companies relying on more innovative machinery can facilitate covering the higher cost of these technologies through government incentives designed to encourage innovation, promote sustainable practices, support workforce development, and enable manufacturing equipment upgrades. Let’s explore several options:

R&D Tax Credits: Fueling Innovation

Most manufacturers are aware of the opportunities presented through R&D tax credits – an essential credit for companies investing in the research and development of new technologies, materials, and processes. These credits can help cover a percentage of companies’ R&D expenses, including wages for R&D personnel, equipment purchases and materials used. R&D tax credits reduce the financial burden of innovation, allowing companies to push the boundaries of what’s possible with 3D printing, particularly in fields where the technology’s unique capabilities are most valuable.

- Example: In the U.S., federal and state-level R&D tax credits provide substantial benefits to manufacturers working on the next generation of 3D-printing technology. These credits help companies fund the development of cutting-edge machinery and advanced materials.

Green Manufacturing Incentives: Encouraging Sustainable Practices

3D printing presents the opportunity to reduce waste and energy consumption versus traditional manufacturing methods, making it eligible for green manufacturing incentives. Green manufacturing incentives can include tax credits, grants or subsidies for companies that invest in energy-efficient machinery, renewable energy sources or sustainable production processes. If a manufacturing company is already working toward more sustainable practices or is interested in exploring renewable energy sources/energy-efficient equipment, understanding what qualifies for this incentive can help lessen the financial investment of implementing these measures.

- Example: In California, manufacturers can qualify for green tax credits or rebates by demonstrating a commitment to reducing waste and energy consumption. For 3D printing companies, this could include using recycled materials or investing in energy-efficient 3D printers, particularly in industries where waste reduction and sustainability are critical.

Manufacturing Readiness Grants: Upgrading Machinery for the Future

Upgrading or replacing traditional manufacturing equipment with advanced systems requires significant investment. To support this transition, many states offer manufacturing readiness grants that help companies purchase or upgrade machinery.

- Example: Indiana’s Manufacturing Readiness Grant Program provides matching funds for companies investing in smart manufacturing technologies, including the most advanced and innovative 3D printing systems. These grants help business leaders stay ahead of technological shifts, particularly in manufacturing, where rapid prototyping and customized production are crucial.

Training Grants: Building a Skilled Workforce

New technology requires a skilled workforce capable of operating, maintaining and optimizing advanced equipment. To help companies equip their employees with the necessary skills, many states and local governments offer training grants that subsidize the costs of upskilling workers.

- Example: Michigan’s New Jobs Training Program (MNJTP) helps companies cover the costs of training new employees for high-tech roles, including 3D printing. By ensuring their workforce is prepared to operate and maintain advanced machinery, these training grants help companies reduce the financial burden associated with adopting new technologies while also supporting workforce development.

The Future of Manufacturing with 3D Printing

The rise of 3D printing is vastly evident in the manufacturing industry, as it offers significant opportunities for innovation, efficiency and customization. While traditional methods remain more cost-effective for mass production of larger parts, 3D printing excels in areas where flexibility, customization and rapid iteration are key.

Government incentives for R&D, green manufacturing, machinery upgrades and workforce training can support this transition. By strategically leveraging these incentives and investing in the necessary technology and workforce development, manufacturers can drive competitive advancements without an overwhelming financial burden, including in 3D printing.

At Sikich, we have a team of knowledgeable tax credits and incentives professionals, who have decades of experience in state, local, and federal tax credits and business incentives. To talk through your goals, please contact our experts.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.