This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Considerations and Pitfalls of Offering a Sign-on Bonus: Manufacturing & Distribution Focus

It’s no secret that the manufacturing and distribution industry has been heavily impacted by the ongoing labor shortage. Business leaders continue to look at, and adjust, the total compensation packages they offer in an effort to appeal to candidates to fill open positions.

In our most recent Industry Pulse survey, we found that only 28% of businesses currently offer sign-on bonuses for shift workers, proving this incentive can be leveraged as a clear competitive differentiator. That being said, there are some drawbacks to sign-on bonuses, and serious thought needs to go into their pros and cons.

This article discusses the elements you need to examine if you are considering adding sign-on bonuses to your compensation package, and the challenges they may bring.

When and Why to Offer a Sign-On Bonus

Sign-on bonuses are great to utilize in unique circumstances. A good way to utilize them, for example, would be to increase the number of applicants for a role that requires high-demand skillsets. In other situations, they could be used to push for relocation of a candidate or when a candidate is leaving a job with a different bonus structure.

This incentive can also be leveraged as a tool to persuade a candidate who may be on the fence about accepting an offer. It can tip the scale for the individual who is passively considering job opportunities or to encourage a candidate to choose your company over a competitor.

Lastly, a sign-on bonus can demonstrate the financial strength of a company.

Sign-On Bonus Considerations

Amount: The amount of a sign-on bonus should be high enough to offer candidates a compelling incentive, but not so high that candidates take the position for the signing bonus alone without intent to stay at the company long-term. When determining how much you should offer, consider the level of the role, the skillset required and market competition.

Amount: The amount of a sign-on bonus should be high enough to offer candidates a compelling incentive, but not so high that candidates take the position for the signing bonus alone without intent to stay at the company long-term. When determining how much you should offer, consider the level of the role, the skillset required and market competition.

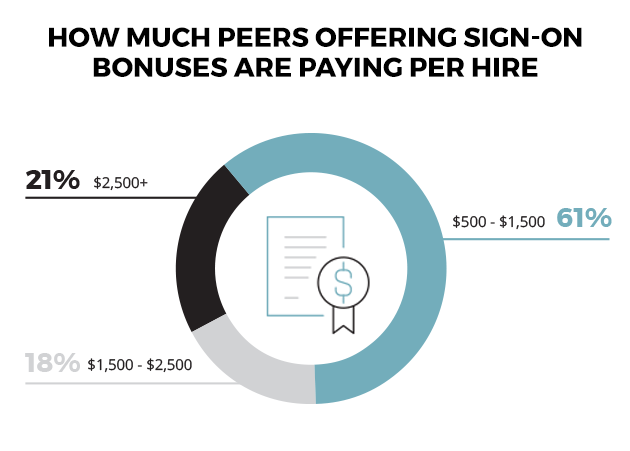

For a shift worker position in the manufacturing and distribution industry, the amount of this bonus typically falls between $500 – $2,500. Narrowing this range even more, our Industry Pulse found that more than 60% of companies that offer shift worker sign-on bonuses said they typically offer between $500 – $1,500.

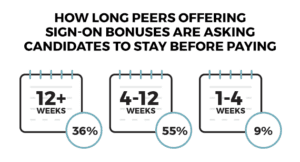

Timing: If you begin to offer a sign-on bonus, always include the length of employment you expect from a candidate in order to receive it. Consider paying out signing bonuses on a schedule, so that the final payment is not made until the employee has been with the company for a certain period. We recommend 90 – 180 days following the start date.

This can keep you from getting burned in the manufacturing and distribution industry where shift worker turnover is frequent. Our Industry Pulse found that between four – 12 weeks is what most others in the industry currently list as their time period for receiving the bonus.

This can keep you from getting burned in the manufacturing and distribution industry where shift worker turnover is frequent. Our Industry Pulse found that between four – 12 weeks is what most others in the industry currently list as their time period for receiving the bonus.

Pitfalls to be Aware of

Be careful not to use signing bonuses as a “quick fix” for larger or underlying problems in your organization, such as the lack of a recruitment strategy, poor onboarding/training process or a negative work environment causing high turnover. Focusing on the problem at hand in any of these situations will be better in the long-term for your company.

Secondly, ensure that your current employees’ wages are competitive so that it does not cause negative feelings from tenured employees that did not receive a sign-on bonus when they joined. Non-competitive wages can increase the risk of further turnover, resulting in even more open roles.

Lastly, do your due diligence to make sure that candidates are truly a good fit for the role and are not just jumping around for extra cash. Keep your eyes on a long-term solution versus a short one.

Talk to our team today:

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.