This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Financial Planning Series Step 6 – Explaining: What is a Monte Carlo Analysis?

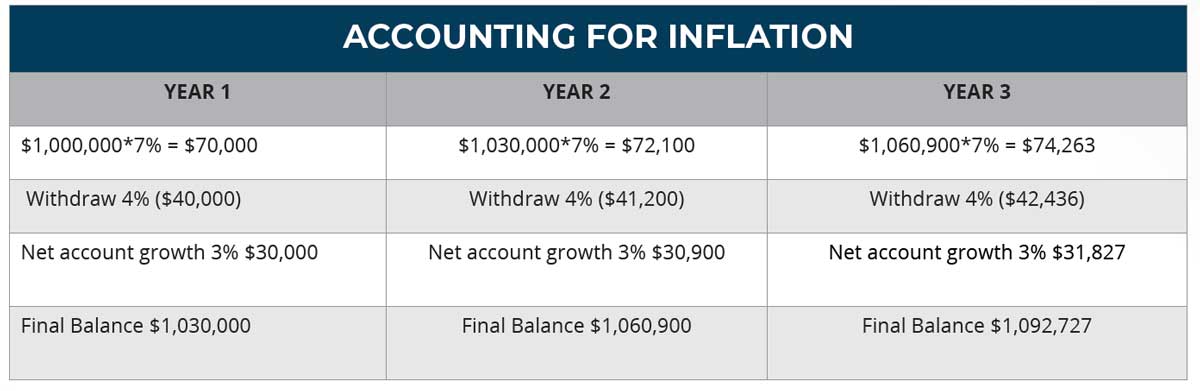

The term Monte Carlo Analysis may make you think of a card game in Las Vegas, but it is an important analysis when evaluating the likelihood that you will have enough money to get you through retirement. The reason you need to grow your account value, in addition to withdraws, is to keep up with inflation. Each year, gas, food, utilities, and living expenses increase with inflation, so you need your portfolio to grow, too.

Unfortunately, the market does not go up at a steady rate each year; therefore, you need to worry about the Sequence of Returns. Let’s look at this concept through a scenario:

What happens if in the year you retire, you withdraw four % and the market declines by 12 %? This would mean at the end of the year; your portfolio would have declined 16%. If you started with $1,000,000, withdrew $40,000, and the market declined $120,000, you would begin the second year in retirement with an account balance of $840,000. In the second year, if you were to withdraw $40,000 from a $840,000 portfolio, the withdrawal rate would be 4.76%, not 4%. The higher the percentage you withdraw from your portfolio, the more likely it is that you will run out of money at some point in the future.

A Monte Carlo Analysis runs 10,000 different random return sequences to predict your future financial outcome. One sequence may have the market increase eight % the first year, decrease 4% the second year, increase 3% the third year, and so on, to see if you will succeed based on your withdrawal rate.

Dependent on the return sequences, you will receive a probability of success. This will never be 100%, because there are no guarantees—but it will give you a probability of success of up to 99%.

If the withdraws are for your core budget expenses, you will want to have a high probability of success. If you have additional expenses that are discretionary expenses, like spending $20,000 a year on travel or giving extra to charity, you may want to have those as separate goals so that you can determine the success of each of them.

It is beneficial to refresh and re-run an analysis each year to make sure you are still on track. A Monte Carlo analysis ultimately answers the question, “Am I going to be okay?”

The hypothetical illustration assumes a seven percent nominal annual growth rate on investments. The illustration does not consider any taxes or fees. Your own account may earn more or less than this example, and income taxes will be due when you withdraw from your account. Investing in this manner does not ensure a profit or guarantee against a loss in declining markets. Investments that have potential for a seven percent annual rate of return also come with risk of loss.

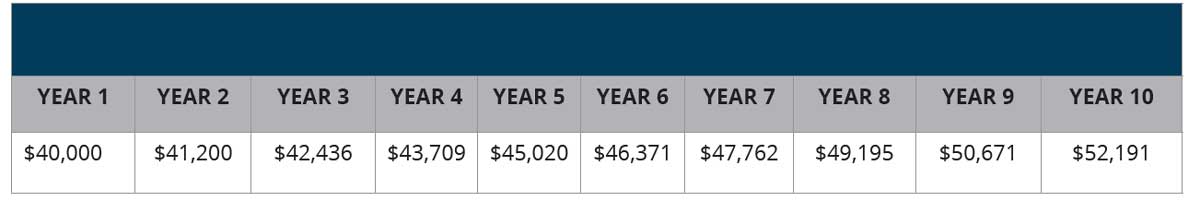

With a three % annual inflation, your living expenses can change every year:

Implementing the Plan

Picture this, you’ve sat down with your Certified Financial Planner (CFP) and laid out your goals, made a budget, set your priorities, set an asset allocation, and found out if you are on track. You are done right? No. Now you have to implement the plan. At this point, you need to be disciplined in making the changes you have outlined.

At the end of the month, check the budget you have laid out and see if you have stuck to it or not. Were your expenses the same as you thought they were going to be? Sometimes birthdays and holidays creep up on us and take a hit on our wallets. Sticking to a budget takes some practice and discipline, but it is doable.

When you set your priorities on how much to save and what debts to pay down first, did you go online and make the change to increase your 401(k) savings rate? Make a list of your debts and cross them out as you pay them off. It feels good when you see yourself making progress.

Update your asset allocation. If you have a Financial Advisor, work with them to update your asset allocation and rebalance your portfolio based on the risk tolerance that you have laid out. If you are doing it on your own, log into your 401(k), IRAs, and investment accounts to update your allocation.

Remember to check your progress. It is not useful to log into your accounts every day to see how much they have changed with the market, but it is useful to review them quarterly. Stay focused on the long-term not the short-term fluctuations.

View other videos in the series:

- Introduction to Financial Planning

- Step 1: How to Start the Financial Planning Process

- Step 2: How to Set Financial Goals

- Step 3: Making a Budget

- Step 4: How to Take a Financial Inventory

- Step 5: Asset Allocation

Advisory services offered through Sikich Financial, an SEC Registered Investment Advisor.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.