This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Leverage Proof of Cash (POC) to Revenue in Your Next Deal

Have you ever begun the process of buying a company where you felt just a little apprehensive? You can be honest with us – if your answer is ‘yes,’ you’re not alone. Acquisitions come with risk. You’re not just acquiring your target’s client base or tapping into its industry specialization, you’re taking on its challenges and setbacks as well. Often, the benefits of acquiring a company you’ve had your eyes on for some time outweigh the risks. However, buyers without the proper due diligence resources in their toolbox take a greater risk than those that perform all the necessary diligence steps. Here’s how you can obtain peace of mind into a company’s financial results with a proof of cash (POC) to revenue:

Understanding how revenue becomes cash

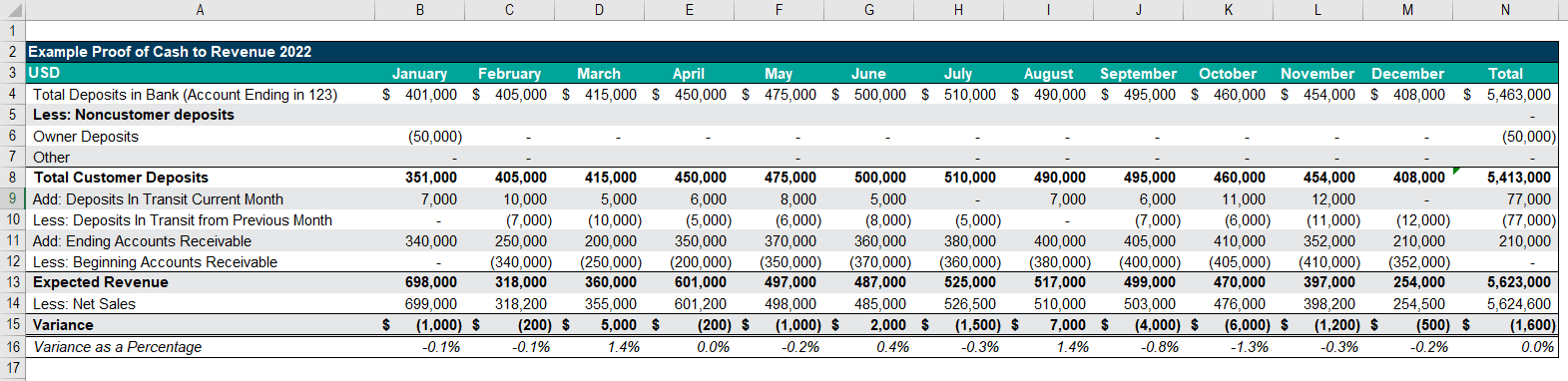

In the buy-side due diligence process, POC is used to understand how and if recorded revenue becomes cash. This is a unique procedure, in that it’s not something every audit will cover. Unlike information gleaned from an income or cash flow statement, a POC identifies the company clients’ bank deposits on the bank statements and directly ties them to the reported revenue. This then demonstrates how revenue historically agrees with cash deposits, so that when you’re considering buying a company, you gain comfort in its top line and have a clearer insight into its financial performance.

Reasons to perform a POC

A POC is an important step in any buy-side due diligence, as it corroborates your target’s reported revenue by tying it with cash deposits from your target’s bank statements. Forgoing a POC may mean taking the target’s reported revenue at face value, which can lead to overpaying for an acquisition, unnecessary legal and other exposures resulting from an error in the target’s top line.

Conducting a POC

Conducting a POC is a fairly simple exercise, where a transaction advisor compares and analyzes revenue figures, usually monthly, and compares them to clients’ cash deposits as they appear on the acquired company’s bank statements to see if they correlate. Buyers partner with transaction advisory firms to perform this due diligence, but mostly, material is obtained from the selling party. Once the advisor has the proper bank documents, they can review for irregularities and red flags.

Why Sikich?

A POC is a critical component within the buyer side due diligence process. Sikich’s transaction advisors know how important this unique step is, and our experts specialize in performing it. For peace of mind, lean on our team for your next deal.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.