Preparing a business case to justify the investment of an ERP solution like, Microsoft Dynamics 365, is no different than building a business case for any other investment. Typically, the business case will include:

- 1, 3, 7-year Total Cost of Ownership

- Business benefits expected to be realized with the new system

- ROI / BVA (Cost / Return)

- Business risks of the status quo

This eBook will take a closer look at these four key areas so you can start creating your business case for Microsoft D365 ERP.

Key Takeaways

- Start your TCO spreadsheet!

- Include both external costs and internal costs.

- Look out 5 – 7 years.

- Consider materiality and probability and document all assumptions.

- Include qualitative as well as quantitative commentary.

- Make the effort to consider your ROI, it will keep business value on the agenda.

TOTAL COST OF OWNERSHIP

As good a source as any for this purpose, Wikipedia (abridged) defines the Gartner coined acronym, Total Cost of Ownership (TCO), as a financial estimate intended to help buyers and owners determine the direct and indirect costs of a product or system. TCO, when incorporated in any financial benefit analysis (like an ROI calculation), provides a cost basis for determining the total economic value of an investment. Determining the TCO is a critical step in building your Microsoft Dynamics 365 business case.

A TCO analysis includes the total cost of acquisition and operating costs and upgrades as well as costs related to replacement at the end of a life cycle. A TCO analysis is used to gauge the viability of any capital investment. It is commonly applied to the analysis of IT products to quantify the financial impact of deploying a product over its life time.

TCO answers the question “How much is this going to cost?” Calculating TCO is valuable for:

- Planning, budgeting and cashflow forecasting

- Making decisions between competing investment decisions

- ROI calculations and cost/benefit analysis as part of a business case presentation

TCO vs. ROI

A TCO calculation is not a Return on Investment (ROI) calculation. For exmaple, the TCO looks at the cost side of the ledger and does not introduce the value side. It does not answer the “how much better off am I going to be in choosing to upgrade over not upgrading” question. For that, you need to know the TCO, but you also need to look at the benefits/value. A TCO is interesting for planning and budgeting, but comparative TCOs are incredibly useful for supporting decisions. Should I upgrade and what will it cost? How do I compare that with the cost of not upgrading or delaying the upgrade for a year? We recommend you consider the options you want to compare and build a TCO for each choice.

A NOTE ON INTERNAL PROJECT RESOURCING COSTS

Implementation projects can be a significant draw on internal resources, and the cost of those resources must be included in your TCO. Depending on the size of your project, the complexity of your requirements, your approach to change management, as well as the speed at which you wish to deploy – you can be looking at part-time commitments from key individuals, to a full-time commitment from many people across the organization.

People

Most organizations identify a set of “Business Process Owners” (or Super Users or Subject Matter Experts) who provide the main point of contact for the partner implementation team. The demands on their time will naturally vary throughout the project. Specific tasks are usually allocated to internal people. For example, data preparation and migration, report writing, system documentation, security set up, and training. You, as a client, are also usually responsible for preparing User Acceptance Testing scripts, and all end-user training. However, it is worth noting that although the train-the-trainer approach is commonly proposed and planned for, it is one area where clients often change their mind. Subsequently, deciding later in the project that they would prefer the partner perform all end-user training.

It is important to have a single person assigned as project or program manager. All but the very small projects benefit greatly from having this as a full-time role. All these internal costs need to be included in your calculations.

Incentives

Some organizations offer their project participants incentives for success (bonuses) and overtime pay for extra hours worked. If appropriate, add an allowance for these costs. Additionally, organizations often include milestone celebrations and off-site workshops to support their change management efforts.

Travel

For distributed organizations, you will also need to plan for additional travel costs including travel time as well as airfares, accommodations, etc.

Most models used by partners to determine resource costs can also provide estimates for your internal team’s commitment. Ask them to provide you with a rough-cut resourcing plan for your team.

A simple way to handle internal resources in your TCO is as follows:

The cost of a $100,000 per annum salaried employee might realistically be close to 2 x their salary. $200,000 divided by available productive hours in a year (say 1760 hours per annum allowing for holidays, vacation, and training time and assuming an 8-hour workday) costs you $113/hour for ‘productive’ capacity. If they are not available for their usual “day job” you may also incur the cost of backfilling their position either by new or temporary hires. Once you start adding up these internal costs, your partner’s consulting rates start to look justified.

CALCULATING A TCO For Microsoft Dynamics 365 ERP

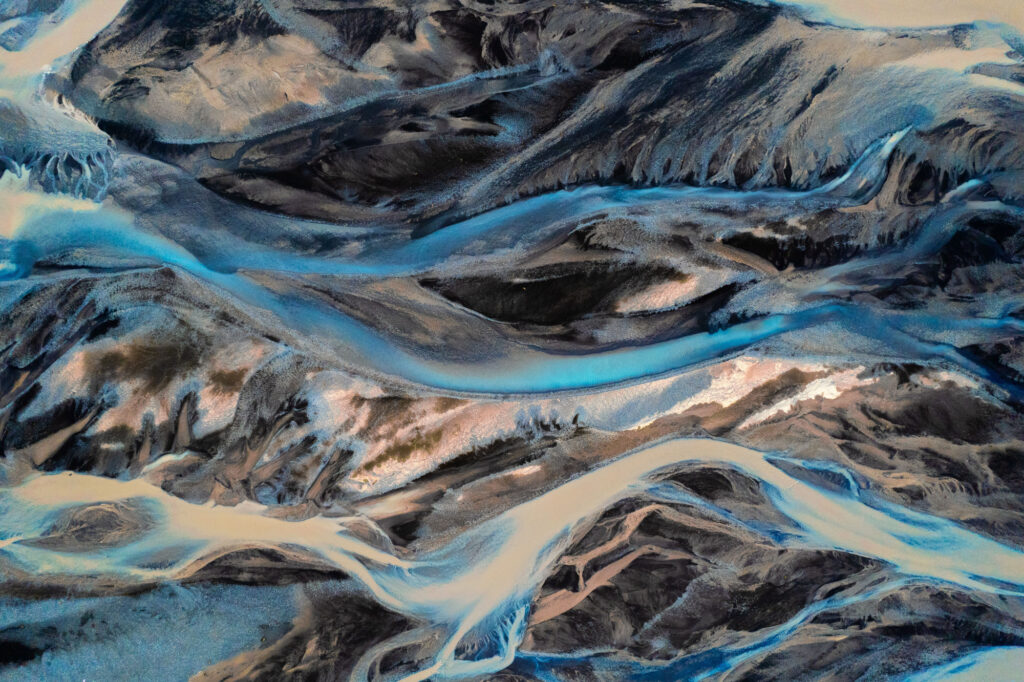

Close your eyes and imagine a spreadsheet. Down the page are the cost components. Across the page are months or years. First, we’ll look at building this spreadsheet down the page. Second, we’ll look at the across-the-page components and considerations when putting together the numerical content for the body of the spreadsheet. Typically, the costs shown down the page fall under the following headings:

Now you have identified the line item costs that you will use in your TCO calculation, you need to consider “across the page” data for the spreadsheet. (That is, how far out your calculations will go). And there are other things you should think through before presenting the information you have gathered.

CAPTURE ALL THE COSTS THAT CAN BE REASONABLY PREDICTED

There are the obvious, reliably estimated and anticipated costs that are clearly identifiable when first considering TCO. Then there are the hidden, unknown, indirect or unreliably estimated costs that could end up being a material component of the TCO. Ultimately the purpose of a TCO is to provide visibility for decision making, and to compare and decide between options. As with most data-based decisions, the quality of decision is dependent on the quality (completeness, validity, accuracy, consistency, availability and timeliness) of the data.

Additionally, TCO calculations may be manipulated, either intentionally or unintentionally, by missing material costs or lacking equivalency (required for a fair comparison). Vendors may not provide you with visibility of all costs. Vendors estimates and quotes often exclude any costs that are not directly revenue to them but are still costs to you (like travel/expenses). It is important to review any vendor provided TCO calculations carefully. We would advise starting with as full and complete a list of all costs as possible. Identify contingencies and unknowns – exclude them from the numbers but be sure to notate any analysis accordingly.

Lastly, it is important for the TCO to include a line item for costs that are material and have a medium to high degree of certainty. As with most forecasting however, there will be events that carry a potentially material cost that lack the certainty needed to justify being included as a line item in your calculations. For these costs, a supporting narrative is more valuable, as including material numbers with a high level of improbability will skew the TCO assessment. Also, consider the level of materiality. Line items can be material because of the dollars associated, or they may be material due to their nature. The best option is to look at the estimated amount as a percentage over the total cost, make a judgement call based on that percentage, and state your assumptions.

STATE ASSUMPTIONS

Your TCO will be based on many assumptions. There is no way to avoid this. With a lack of certainty, transparency becomes more important, so ensure the assumptions are clearly listed. When creating multiple TCO calculations for comparing options, assumptions should be consistent across the options.

CONSIDER CERTAINTY, PREDICTABILITY AND RISK

As with any forecasting activity, there will be numbers that will have a high degree of certainty, and numbers that do not. How certain are you that your vendor quote for implementation will be met, and the project will be on time and on budget? In the same way, costs that will be incurred sooner will be more easily estimated than costs in years to come. Will Microsoft raise the subscription cost of Dynamics after the 3-year contract on the Enterprise Agreement (EA)? The Cloud Solution Provider (CSP) pricelist is monthly and the fine print includes the ability for Microsoft to raise prices at any time, with notice. Some TCO preparers will look to add contingencies to reduce the risk of underestimating costs. It is useful to include contingencies, but they should be classified separately so that the element of risk is separately visible in any summary analysis.

COVER A RELEVANT DURATION

ERP TCOs typically span multiple years to capture costs over the “life of the product.” Many product vendors suggest that the product life could be virtually “forever.” This is because the new Cloud-based SaaS solutions are continually patched and updated, and users are contractually obliged to keep their systems current – there will be no more “revolutionary” upgrades in the future. Historically we created TCO’s based on periods dictated by the underlying aging of servers. These days, with cloud computing, the assumption is that:

- New versions are made available every six months. Allow for taking these updates within 3 months of their release.

- Updates will spin up opportunities for adopting improved technology or improved functions. Make an allowance for an ongoing cadence of improvement projects.

- As the business grows, the business applications need to adapt to keep pace. If your business plan anticipates large periods of growth, make sure the cost of change within your ERP is also reflected.

CONSIDERING OPEX VERSUS CAPEX

When you look at TCO through finance eyes, you look at numbers a little differently than when you look at them from an accounting perspective. If possible, you should collect data sufficient to look at TCO from both viewpoints. For analysis and particularly for calculating an ROI, it is the finance model that is most often used. For corporate budgeting, the impact on the financial accounts will be required. To ensure the TCO can feed into both perspectives, the TCO model should include non-cash impacts like depreciation as well as extended cash impacts such as taxation calculations. It is also worth considering the accounting treatment of cloud solutions. Note that cloud-based applications do not have the same CAPEX considerations that traditional ERP Solutions had that were deployed on-premises. Consult your CPA for more insights on this.

COMPARING TCO RESULTS

The difficulty with comparative TCOs is that at times you might be comparing two scenarios that are so significantly different that there is little overlap of data points. Further, when considering TCO for ERP decision-making, simply comparing the numbers does not give the audience enough information to make an informed decision. Consider the risk inherent in the numbers, comparatively speaking. What level of variability does a Cloud subscription to compute resources have compared with a properly serviced data center? What TCO comparisons you prepare, will very much depend on where you’re coming from, and the choices you are open to considering. Invariably one of the options will be to do nothing. In this context, this means to not upgrade or implement. A fair assessment of the “Do Nothing” TCO is always important for decision-makers – even if they have expressed 100% commitment to an upgrade or system change.

It is also useful to consider preparing a TCO for various scenarios. Presuming high business growth (say >15%) will create a different TCO than assuming no growth. Presuming that you are “all-in” with your ERP options, including all Independent Software Vendors (ISVs), all Business Intelligence options, a full roll-out, will give you a different result than if you take a more conservative or “phased” approach. When deciding how many models to prepare, consider the most likely scenarios as well as alternative scenarios for comparison. This may help you determine a possible TCO range, which is more reliable than a single number.

REPORTING THE QUANTITATIVE AND THE QUALITATIVE FINDINGS

When we talk about TCO, we are focused on the cost side of the ledger. And when considering costs (just as we do when considering benefits) it is important to provide a framework to assess the qualitative data that might differentiate the choices. A way to consider qualitative costs, (the difficulty finding qualified technical employees for example) is by identifying the costs and presenting them using impact/cost quadrant graphics. This way, your TCO report can consider costs that are not quantifiable but could be material to the overall investment.

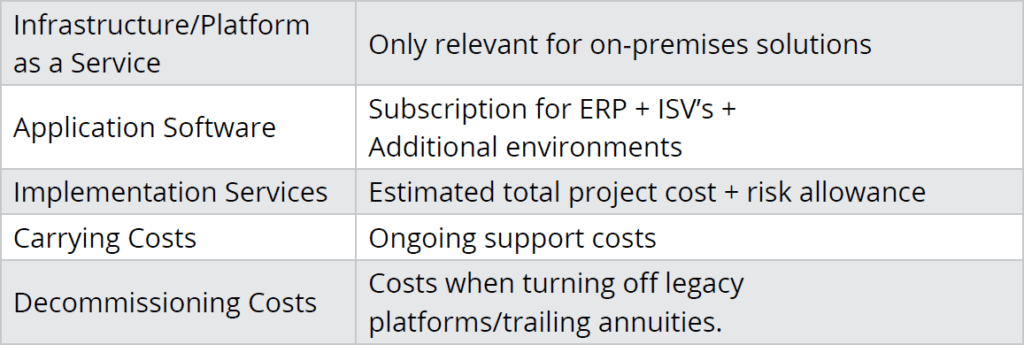

THE VALUE SIDE OF THE EQUATION – RETURN ON INVESTMENT AND BUSINESS VALUE ASSESSMENTS

When creating a business case in support of a change, stakeholders want to know what business benefits will be accrued from the investment. Unfortunately, the ability to put a dollar figure on the benefits can be so arbitrary that attempts to quantify benefits can be met with a high degree of distrust – particularly with CFO’s. Notwithstanding, you must attempt to tie specific measures, that is, hard numbers, to the benefits. By doing this, project participants are forced to zero in on the components of the project where tangible dollars are expected to be realized. ERP projects can be by nature large and wide-ranging. Having the project participants, from those seeking project approval to those in deployment, understand where the value is being sought, helps with prioritizing effort.

We recommend that to complement numerical measures, also use visual tools in your business case. An example is a Matrix diagram, to clearly present the qualitative benefits you are looking for.

The following financial measures are generally sought:

The benefits for implementing a new solution generally fall into one of three buckets:

- Increasing revenue

- Reducing cost

- Reducing business risk

Top 3 rationale categories

- Productivity – from introducing new processes and automation an organization can reduce the human effort. You can also reduce the cost of errors and increase throughput using the same number of resources. Do more with less.

- Information – getting better real-time information faster with greater accuracy means improved decision-making and better forecasting. Examples include:

- Faster, more accurate quoting

- Improved decisions regarding pricing and product mix/promotion

- Application of Artificial Intelligence and Machine Learning to identify market trends

- Asset Management – Improved ways to manage assets impacts revenue, customer satisfaction, supply chain processes, production, and costs. This might include:

- Tools for forecasting, planning, purchasing, scheduling, managing supply chain, to better manage inventory

- Move from reactive to predictive asset maintenance – reducing downtime, rework, etc.

- Customer self-service can streamline the ordering process, and increase customer satisfaction. ERP estimating tools bring real-time insight into production costs by job.

NEED help WITH your DYNAMICS 365 PLANS?

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.