One of the main requirements for any ERP system is to provide control over postings from source subledger transactions to the General Ledger. Reconciling the General Ledger to the subledger must be automatic with every detail posting to the control account being fully visible for reconciliation and audit purposes. For us accountants, we expect to have this level of detail, control and automation in an ERP system.

In Dynamics 365 Finance and Operations (D365FO), this is handled very effectively using Posting Profiles. Although the terminology for the setup in certain modules is different, they all function in the same way in that they effectively control the subledger transaction postings to the General Ledger.

But not only do they control posting from the subledger to the General Ledger, they provide flexibility in the way General Ledger accounts are used in a subledger transaction, and they are important tool in tracing transactions through the General Ledger.

Posting Profiles – Control over posting

Posting Profile setups include interactions with the following subledgers:

- Accounts payable

- Accounts receivable

- Cash and bank

- Inventory

- Production

- Fixed assets

- Project management and accounting

Once these Posting Profiles are in place and validated, they are used to automatically assign the required control accounts on the originating subledger transactions. This provides assurance that the source transaction posts to the correct control GL account.

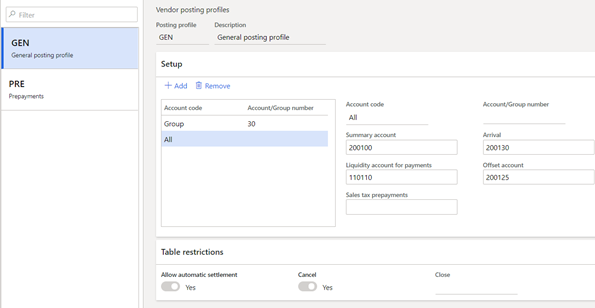

For example, look at the vendor Posting Profile below. The GL account is set to 200100 under Summary account, which means that all Accounts Payable transactions will default to the account 200100.

When an AP invoice journal is created, the credit to accounts payable will automatically default to account 200100. When a Vendor check is created and posted, the debit will automatically post to the same account.

Users are not able to change this posting at a transaction level. When the transaction type of Vendor is selected during AP Invoice entry, or when creating the AP check, the system automatically pulls the account from this setup. This reduces the amount of differences made to the GL account from users making decisions on a transaction by transaction basis, expedites data entry, and improves accuracy.

This also means that when reconciling the Accounts Payable subledger to the General Ledger, the reconciliation will be “right on the money.” I very rarely see subledger balances differ from the General Ledger for this reason–Posting Profile setups control the transaction. In the rare case where the subledger balance differs from the GL balance, the “rogue” transaction stands out in the detail.

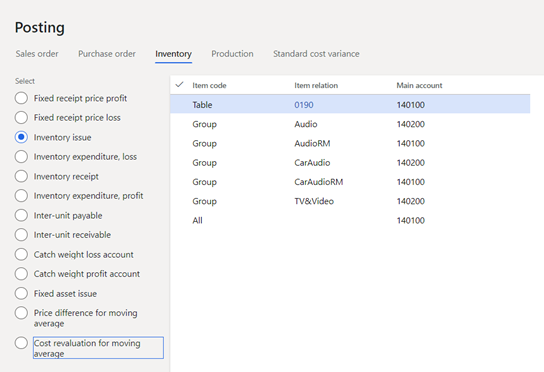

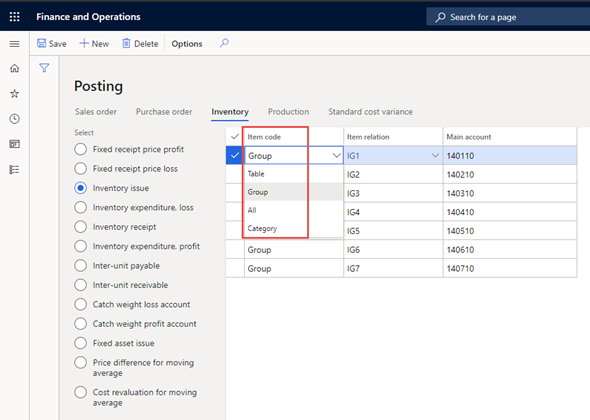

This functionality is the same across Vendors, Customers, Fixed Assets, Production, Inventory, and Project Accounting. In the example below, we have the Posting Profile for Items (Inventory Management > Posting > Posting).

This Posting Profile is bit a more involved, but it is the same concept. The transaction type, Inventory Issue, is for an inventory adjustment out or a negative inventory adjustment. When an inventory adjustment transaction is created, the General Ledger account for the inventory item cannot be updated at the transaction level; the account pulls from this Posting Profile based on the setup.

This takes the decision-making process out of the hands of the users and reduces the errors and variances when reconciling inventory each month. In the above example, when a negative inventory adjustment is posted, the General Ledger account for the inventory item, inventory group, or all items will pull from this Posting Profile.

Posting Profiles – Flexibility with Posting to GL Accounts

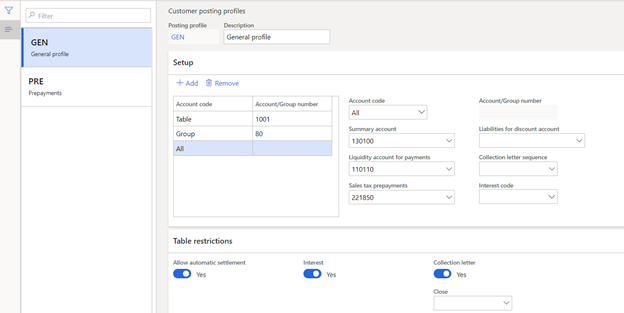

D365FO Posting Profiles also offer the flexibility to record transactions with various levels of detail that are required to have accurate posting. Let’s look at the Customer Posting Profile tab for an example:

Notice that the ledger account specified can be set on the Customer Account code for:

- All Customers (All)

- Customer group (Group)

- A specific customer (Table)

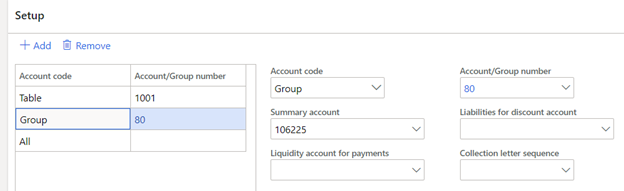

In this example, if you were looking to book a different Accounts Receivable account for a specific customer group, you would select the Customer Group and the corresponding Summary GL account for this group. These may be retail customers, foreign customers or maybe a government agency where the requirements for tracking the balances in the General Ledger may dictate separation for financial statement purposes.

When the order is invoiced for a customer within this customer group, the Accounts Receivable invoice balance will automatically be debited to account 106225. In addition, when the payment is received for a customer within this customer group, the AR balance received will be credited to account 106225.

Additionally, you have the option to track the control account at a specific customer level as well. The requirement may be that the Accounts Receivable balance be tracked as a Note Receivable. The terms of the sale may have been set to where the customer pays the balance over a year.

To update the Posting Profile for the specific customer, enter the account code “Table,” and select the customer account. In the Summary account field, enter the specific General Ledger account for the customer. There is no limitation to the number of customers or customer group that you can enter in the Posting Profile.

The order for the sequence of the Posting Profiles is important. In the example above, the system will look at the specific “Table” Account code first, then the Account code “Group” and finally the catch all Account code “All.”

For inventory postings, notice below that the ledger account specified can be set on the Item code for:

- All items

- Item group

- Item category

- An individual item

The Item relation in the second column is dependent upon the selection made in the Item code.

The Item code Category is used for purchasing non-inventory procurement categories. This is not used for inventory transactions, but the setup is managed for purchasing, receiving and sales within the item Posting Profile.

Posting Profiles link to Posting Types

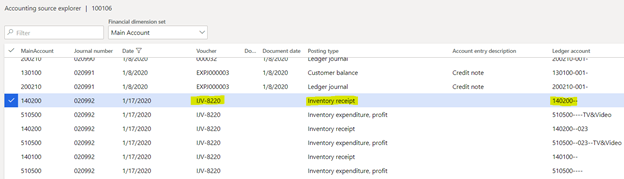

When reviewing a transaction voucher, it is important to not only look at the debits, credits, and the ledger account, but to also pay close attention to the posting type that is driving the transactional posting. The posting type identifies the Posting Profile that is used to map the transaction flow to the ledger.

A great tool for tracing transactions is the Accounting source explorer. With the Accounting source explorer, you can select a range of dates to view detailed ledger transactions. From there, you can filter your transactions by the posting type.

Below highlighted, is a posting type Inventory receipt. You can filter all the transactions with this posting type to review the detail behind each transaction. Inventory receipts and Inventory expenditures are defined in the Posting Profile setup.

Posting Profiles are required for updating General Ledger accounts from the subledger to the General Ledger in D365FO. When these are set up and tested properly, they provide tremendous benefit for control, flexibility and tracing across your organization.

Have any questions about using D365FO Posting Profiles? Please reach out to one of our experts at any time!