Part of a recent NetSuite release, Customer Installments are easy and an extremely helpful tool to automate customer receipts and revenue. The feature is used to create installments for your customers who pay for items over a period of time. It’s an easy feature to turn on. Your account administrator can navigate to Setup > Company > Setup Tasks > Enable Features > Accounting > Installments. Switching this on will turn on Installments on both the accounts receivable and the accounts payable sides. However, before activating it in your production environment, reach out to your NetSuite Consultant or test it in your sandbox environment.

Using NetSuite Customer Installments

By turning on this feature, you are adding a checkbox on a Term Record, labeled as Installment. Checking this box on the Term will add additional fields, such as recurrence count and recurrence frequency. Here, the user defines how often the Installment Payment will occur and in what amounts. If the Installment occurs in equal amounts, there is a split evenly button, which will divide the total amount of the transaction by the frequency of the Installment.

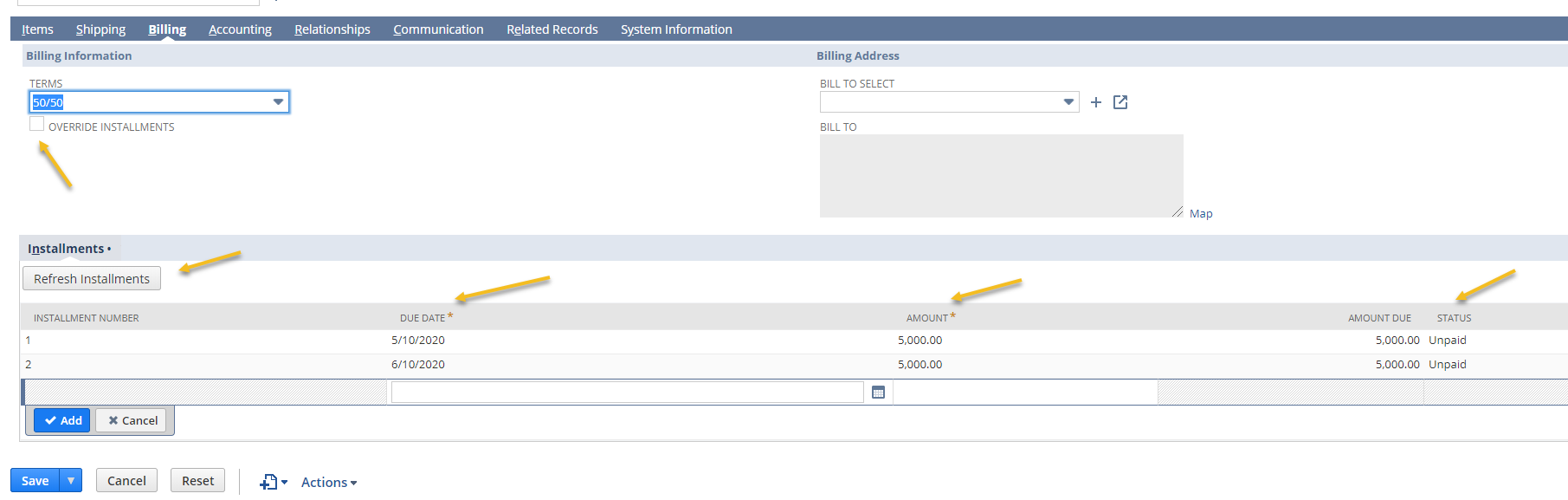

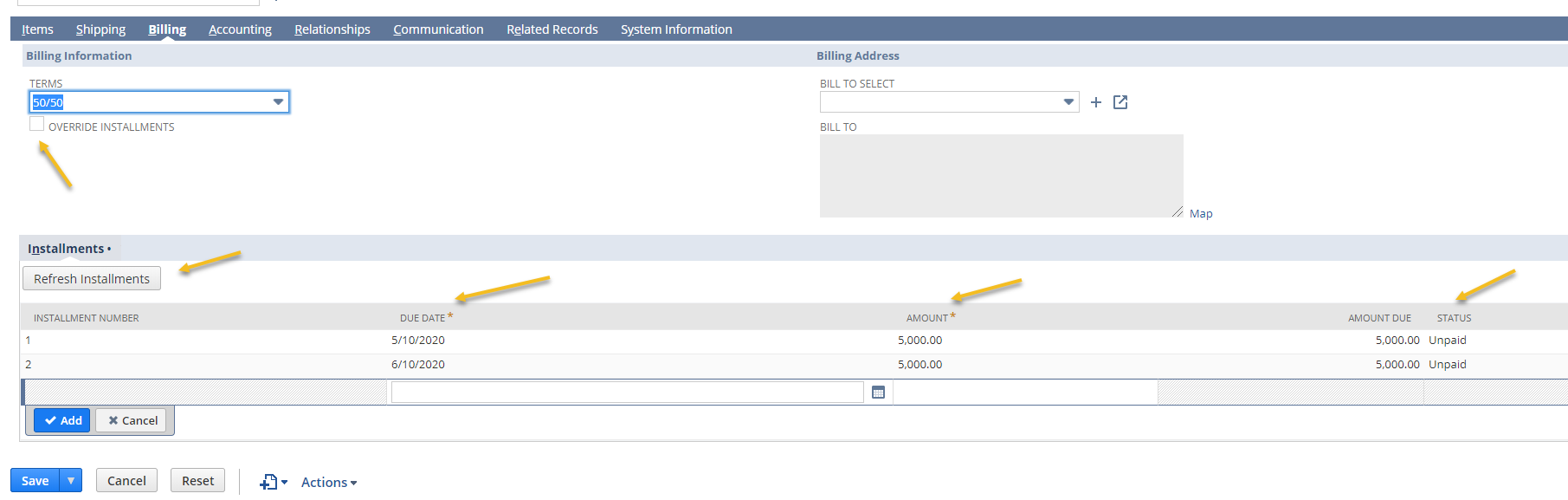

While the initial setup is straightforward, there are some great benefits to having a few Installment rules. While it is easy to define your 6-month Installment plans, it can be tricky to define your one-offs—the customers who need unique Installment plans, and where you have to satisfy those needs. NetSuite thought of these one-offs, and you can create a Custom Installment Plan. Sikich recommends setting up one of these Custom Terms, which allows the user to then define the Installment Plan directly on the Sales Transaction by clicking the Override Installments button on the Billing subtab. Just make sure that the total Installment Amounts are equal to the full Transaction Amount!

The Installment Payment Process

When a customer is ready to begin paying their invoices, NetSuite has done a few things to make this process easier. For example, when a Customer pays an amount greater than the projected installment amount, the overage amount will be applied to a future Installment. If that overage amount is less than a full installment amount, the status of that installment would be partially paid. The same goes for the Accounts Receivable Aging. The aging will show a late installment as past due and not for the full invoice amount.

There are some smooth applications of Customer Installment Plans throughout NetSuite. You’ll be able to modify Installment Plans on the sales transaction if they are unpaid, which makes it easier to adhere to your customer’s potential needs. Speaking of the customer, with some slight customization, you can bring the Installment Plan’s dates and amounts onto your sales transaction PDF file. Rather than maintaining Excel schedules to line up your customer’s payment plans, NetSuite Customer Installments easily creates customer account transparency between you and your customers.

Check out our Part II of Installments, Vendor Installments, in an upcoming post.

If you have any questions about setting up and using NetSuite Customer Installments, please contact us at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.