This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

- Audit and Assurance

- Business Succession Plan

- Business Transformation

- Cloud Services

- Consulting Services

- CRM and ERP Products

- CRM Services

- Cybersecurity

- Data and AI

- ERP Services

- Forensic and Valuation

- Governance, Risk and Compliance

- HEADSTART Implementations

- Human Capital Management and Payroll

- Insurance Services

- Internal Audit

- Contact

- Services

- Audit & Assurance

- Business Succession Plan

- Business Transformation

- Cloud Services

- Consulting Services

- CRM and ERP Products

- CRM Services

- Cybersecurity

- Data and AI

- ERP Services

- Forensic & Valuation

- Governance, Risk and Compliance

- HEADSTART Implementations

- Human Capital Management & Payroll

- Insurance Services

- Internal Audit

- Investment Banking

- Lender Services

- IT and Managed Services

- Marketing and Communications

- Modern Workplace

- Outsourced Accounting

- Regulatory, Quality & Compliance

- Site Selection & Incentives

- Spend Management

- Tax

- Transaction Advisory

- Wealth Management

- Workforce Risk Management

- Industries

- Construction & Real Estate

- Discrete Manufacturing

- Federal Government

- Financial Services

- Government Contractors

- Industrial Equipment Manufacturing

- Life Sciences

- Manufacturing and Distribution

- Not-for-profit

- Process Manufacturing

- Professional Services

- Rolled Products

- State & Local Government

- Title IV Audit & Consulting

- Distribution & Supply Chain

- Insurance

- Insights

- About

- Locations

- Careers

- Pay

NetSuite Vendor Prepayment Enhancements

Do you have vendors that require deposits before they will begin work on a project for you? NetSuite now has the ability to not only record these prepayments in a way that is easy to report on, but also allows for the automatic application of them to their associated vendor bills, reducing manual efforts and saving time.

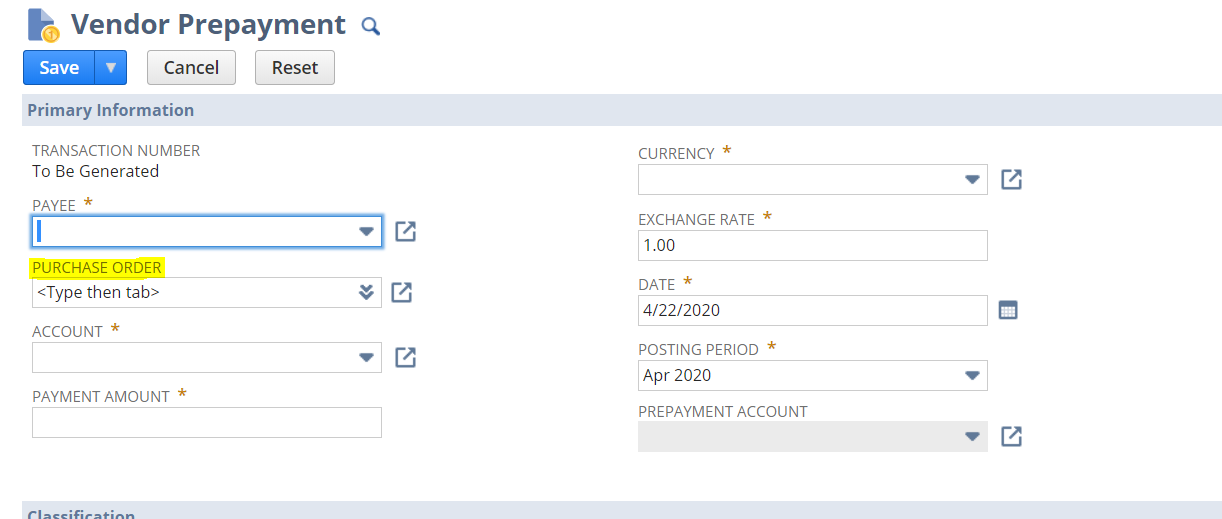

In order to automatically apply it to a vendor bill, a Purchase Order and Vendor Prepayment must be linked. This can be done by creating a new prepayment and selecting a Purchase Order in the new “Purchase Order” field.

Once the you apply the prepayment, it is not possible to change the linked Purchase Order. However, it is possible to manually apply a remaining amount to a Bill that is from a different Purchase Order as long as it has the same Vendor, Currency and Subsidiary.

Some additional enhancements include the following:

- The ability to allow for Vendor Bills to be approved in the Employee Center role (this permission must be manually enabled as it is not a default permission);

- Support for Custom GL Lines;

- Improved validations to minimize errors when multiple users work with vendor prepayments concurrently; and

- Exposure of Vendor Prepayment records in SuiteScript.

Setting Up NetSuite Vendor Prepayments

To start using NetSuite Vendor Prepayments:

- Navigate to Setup > Company > Enable Features > Accounting > Advanced Features and check the Vendor Prepayments box.

- Set up a Vendor Prepayment account

The Auto-Apply Vendor Prepayments preference will be set by default for all prepayment transactions that meet the Auto-Apply conditions. If your settings to not meet the conditions, you will have to manually apply the prepayment. If you want only to apply manual payments, you must turn off the Auto-Apply preference by navigating to Setup > Accounting > Preferences > Accounting Preferences > Accounts Payable.

Have any questions about NetSuite vendor prepayments? Please contact us at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.

About the Author

Leigh Andonian

Leigh Andonian, MBA, MSA is a Netsuite Implementation Consultant at Sikich.

Sign up for Insights

Join 14,000+ Business executives and decision makers.

Latest Insights

Technology

What Is a Project Manager?

February 27, 2025

Construction

Why Industry-Specific Tech Partners Matter in the Constructi...

February 26, 2025

Article

Ensuring Financial Compliance in CPA Firms

February 26, 2025

Technology

Navigating CMMC Compliance and Risk Management: Essential St...

February 25, 2025

ERP

How Cloud ERP Overcomes the Hidden Costs and Customization C...

February 24, 2025

NetSuite

Speeding Up the Month-End Close: How Legacy ERP Holds You Ba...

February 21, 2025

Dynamics 365>Dynamics 365 Business Central

Why Nonprofits Need to Move Off Dynamics GP and Consider Mic...

February 20, 2025

Salesforce

Revolutionizing Sales Assignments and Workforce Management i...

February 19, 2025

Technology

Understanding the ‘Overwrite Return Path’ Settin...

February 18, 2025

Article

Translating Legacy Knowledge with Automation in Manufacturin...

February 14, 2025