New rebate functionality was introduced with the April 2021 release of Dynamics 365 Finance & Supply Chain Management (also known as D365FO). This new functionality wasn’t just new fields or parameters for the existing rebate agreement functionality; this was a brand new rebate management module that condenses vendor rebates, customer rebates, and customer royalties in one place!

If you were to look at the rebate agreement screen side-by-side with the new Rebate management deal screen, there are a lot of new fields and ways a rebate can be configured. This is the first blog post (in what I hope will be many) that will deep dive into the new D365FO rebate management fields and configurations. Let’s start with the new calculation method feature.

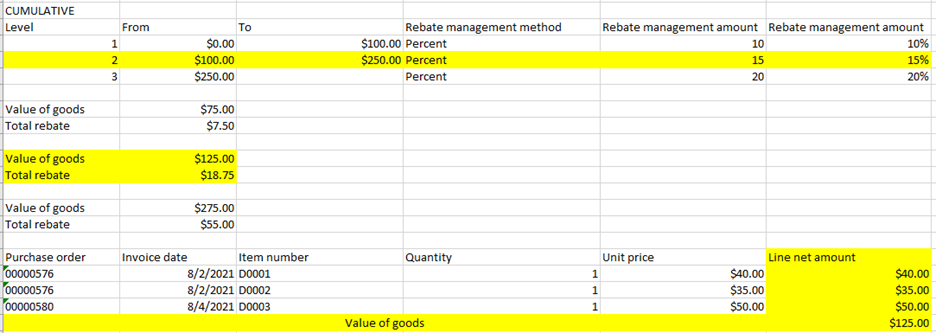

Cumulative Calculation Method

To level-set, there is only one calculation method with the “old” rebate agreement, which is a Cumulative Method. With this method, just one calculation level is used to calculate the rebate. If multiple levels are available, the highest-value or highest-quantity calculation line that is reached is used for the whole quantity or value. This is by far the most common calculation method when I’ve implemented rebates for clients, and the new rebate management deal still provides the Cumulative Method.

In the below example, even though each individual Item number would be placed in Level 1, the sum of all Item numbers is used to determine the level. Since the sum of all Item numbers is $125.00, Level 2 is used to take 15% of $125.00. If the sum of all Item numbers were a different dollar amount, those examples are provided as well.

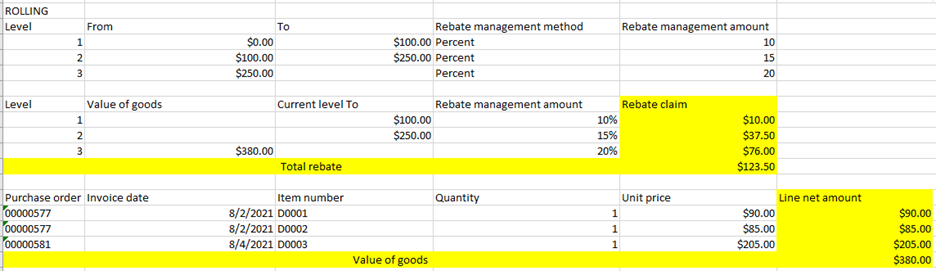

Rolling Calculation Method

Now, let’s talk about the new calculation method options. First is the Rolling Method. The Rolling Method calculates all possible levels for the deal. If there are multiple levels, and more than one of them is reached, all the levels that are reached will be used, but upper thresholds apply to each percentage.

In the below example, even though each individual item number would be placed in different Levels, the sum of all Item numbers is used to determine the Level. Since the sum of all item numbers is $380.00, all levels are used.

Level 1 contributes $10.00 to the total rebate because the upper threshold of Level 1 ($100.00) is multiplied by the rebate management amount (10%) for Level 1.

Level 2 contributes $37.50 to the total rebate because the upper threshold of Level 2 ($250.00) is multiplied by the rebate management amount (15%) for Level 2.

Level 3 contributes $76.00 to the total rebate because the total value of goods ($380.00) lands in Level 3 which is multiplied by the rebate management amount (20%) for Level 3.

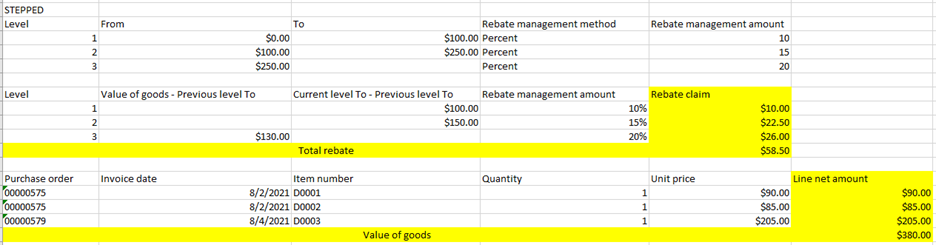

Stepped Calculation Method

Second is the Stepped Method. The Stepped Method calculates all possible levels for the deal. If there are multiple levels, and more than one of them is reached, all the levels that are reached will be used, and each line incrementally contributes.

In the below example, even though each individual item number would be placed in different levels, the sum of all item numbers is used to determine the level. Since the sum of all Item numbers is $380.00, all levels are used.

Level 1 contributes $10.00 to the total rebate because Level 1 is incrementally $100.00 and the rebate management amount (10%) for Level 1 is applied to that incremental amount.

Level 2 contributes $22.50 to the total rebate because Level 2 is incrementally $150.00 and the rebate management amount (15%) for Level 2 is applied to that incremental amount.

Level 3 contributes $26.00 to the total rebate because the total value of goods ($380.00) lands in Level 3, which is incrementally $130.00 and the rebate management amount (20%) for Level 3 is applied to that incremental amount.

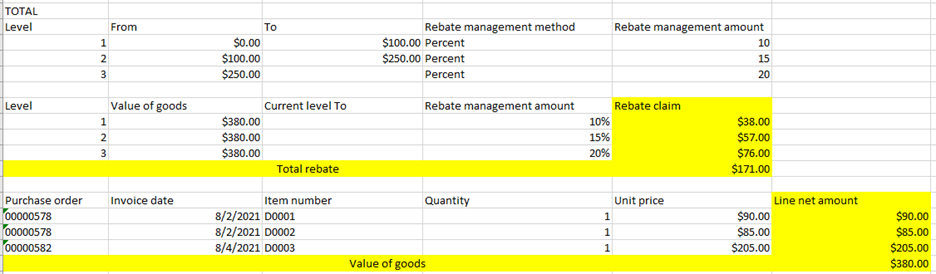

Total Calculation Method

Last is the Total Method. The Total Method calculates all possible levels for the deal. If there are multiple levels, and more than one of them is reached, all the levels that are reached will be used with the percentage of each level applied to the total value of goods.

In the below example, even though each individual item number would be placed in different levels, the sum of all item numbers is used to determine the level. Since the sum of all item numbers is $380.00, all levels are used.

Level 1 contributes $38.00 to the total rebate because the total value of goods ($380.00) is multiplied by the rebate management amount (10%) for Level 1.

Level 2 contributes $57.00 to the total rebate because the total value of goods ($380.00) is multiplied by the rebate management amount (15%) for Level 2.

Level 3 contributes $76.00 to the total rebate because the total value of goods ($380.00) is multiplied by the rebate management amount (20%) for Level 3.

And that’s just the tip of the iceberg for new D365FO rebate management functionality! Again, my plan is to write more about the new rebate management module. While you and I are here, I’d like to pose the following questions, as I’m still learning myself!

-

- The new rebate management module allows you to configure how often to cumulate/accrue and how often to claim a rebate. What I’ve typically seen is clients wanting to cumulate/accrue on a monthly basis and claim the rebate at the end of the contract. Does anyone out there know how this would be configured in the rebate management deal, dates section?

- Dovetailing from the first question, does anyone out there know how to accrue rebates with the new rebate management module? I’ve just been creating the claim and posting to the general ledger right away, but I feel like I should be using the Process Provision and Post Provision at some point in the flow of work.

Have any other questions regarding D365FO? Do not hesitate to reach out to our experts at any time!

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.