Many borrowers of the Paycheck Protection Program (PPP) loan are now in the process of submitting loan forgiveness applications, with the expectation that their company may be able to recognize and account for the partial or full PPP loan forgiveness during the current reporting period. In this article, we list some factors to consider when managing your net income during the current reporting period, as well as the potential tax implications of recognizing loan forgiveness.

Reporting Period Net Income Management

The timing of when your business can recognize or account for the PPP loan forgiveness may depend on when you receive a conditional or final approval of the loan forgiveness from your respective lenders. It would also depend on the accounting method you adopted for the PPP loan forgiveness.

The recognition of the PPP loan forgiveness during the current reporting period will result in an increase in your book income. Below are several factors to consider when managing your company’s net income during the current reporting period:

Bad and Doubtful Accounts Receivable: Perform a detailed review of the accounts receivable balances prior to and/or as of current year-end. If there are bad and doubtful accounts receivable balances for which management has exhausted all collection measures, and if the collectability of those receivable is remote/unlikely, consider a direct write-off of those accounts receivable balances (instead of providing an allowance for doubtful accounts receivable, which is not an allowed deduction for tax reporting purposes);

Bad and Doubtful Accounts Receivable: Perform a detailed review of the accounts receivable balances prior to and/or as of current year-end. If there are bad and doubtful accounts receivable balances for which management has exhausted all collection measures, and if the collectability of those receivable is remote/unlikely, consider a direct write-off of those accounts receivable balances (instead of providing an allowance for doubtful accounts receivable, which is not an allowed deduction for tax reporting purposes);- Obsolete and Slow-Moving Inventories: Perform a detailed review of the on-hand quantities of inventories and identify and isolate the obsolete or slow-moving inventory items. Determine the estimated net realizable value for those items, including the need to provide price discounts to sell the items. Isolate and segregate those inventory items, make them available for sale, and take proactive steps to sell or dispose of the items prior to year-end. If the estimated net realizable value is lower than the carrying cost, make appropriate adjustments to the carrying cost of the inventory items (instead of creating an allowance for obsolete or slow-moving inventories, which is not an allowed deduction for tax reporting purposes);

- Work in Process: Perform a detailed review of the balance of unbilled work in process prior to and/or as of the current year-end. Identify any unbillable work in process, including unapproved change orders, where the probability of billing is remote or unlikely. Write-off these unbillable costs during the current reporting period;

- Purchase of Consumables: If the company’s accounting policy is to expense the purchases of consumables (including manufacturing plant/administrative office supplies and personal protective equipment) in the year of purchase, review the available quantities of consumables to determine if additional bulk purchases during the current reporting period would be appropriate;

- Write-off of Fixed Assets: Consider performing an inventory of fixed assets to identify any assets with remaining net book value, which are neither in use nor expected to be used. Discard these assets and write-off the remaining net book value during the current reporting period;

- Impairment of Tangible Fixed Assets: A business consequence of COVID-19 could be a potential impairment of long-lived tangible assets. Therefore, management could perform a detailed assessment of the carrying costs of the tangible fixed assets to identify any impairments and make the necessary adjustments during the current reporting period;

- Impairment of Intangible Assets: Similar to a review of the tangible fixed assets, management could analyze any impairments of finite and infinite lived intangible assets and make necessary impairment-related adjustments during the current reporting period;

- Repairs and Maintenance: Management could reassess the timing of any scheduled and anticipated repairs and maintenance. Consider the option to accelerate the timeline to perform the repairs and maintenance during the current reporting period;

- Compensation to Employees: Perform an assessment of employee compensations and consider if one-time COVID-19-related compensations to employees would be appropriate, such as hazard pay (bonus) or additional compensations to frontline workers during the current reporting period;

- Related Party Leases: Review the related party lease agreements to assess if the monthly lease rentals are consistent with prevailing market rates for similar properties. If they are not, consider making appropriate revisions to the lease agreements for rental charges during the reporting period;

- Lease Amendments: Consider the possibility of making amendments to the existing lease agreements in response to COVID-19-related changes in the company’s business operations (including the potential reduction in the lease period, leased space, etc.). Reasons for such a change could be due to employee turnover and remote working. Any costs (including penalties) related to such amendments could be absorbed during the current reporting period;

- Interest Charged on Related Party Payables: For amounts due to related parties, including notes payable, reassess the reasonableness of the interest rates charged and consider making appropriate revisions to the interest rates;

- Pending Litigation: Management could review any outstanding litigation matters and assess the opportunities to settle pending matters, including through arbitration, during the current reporting period. The settlement amounts and the related expenses could be charged off during the current reporting period;

- Business Combination Related Activities: Management could reassess the timing of performing activities related to ongoing or anticipated mergers and acquisitions. Consider the opportunities to accelerate the timing of such activities, since most costs related to mergers and acquisitions could be expensed during the current reporting period.

Paycheck Protection Program (PPP) – Tax Considerations

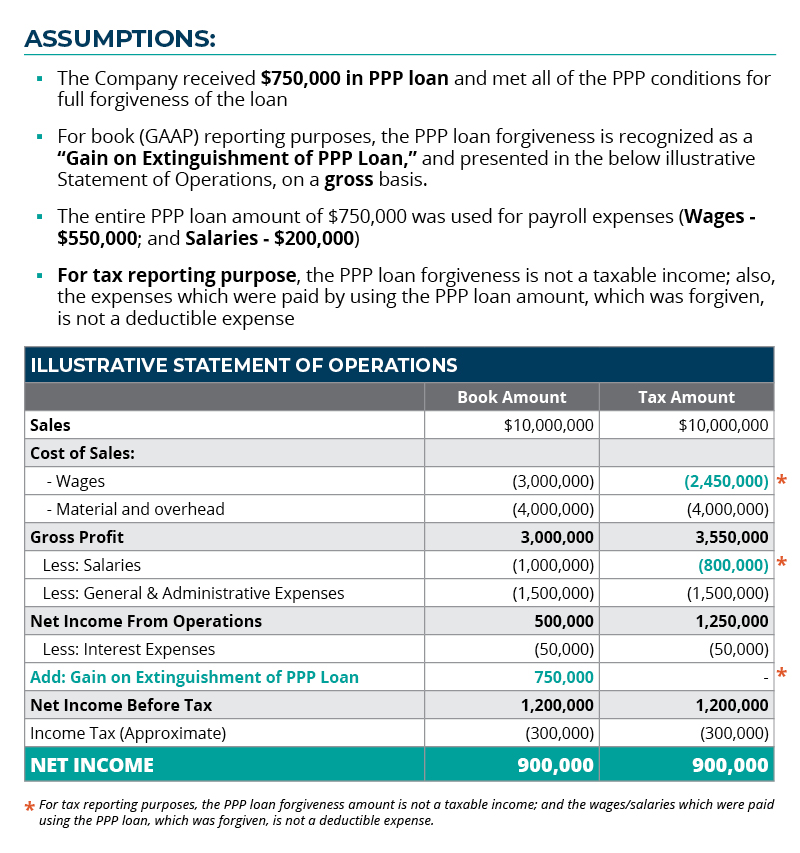

Manufacturers must also analyze the tax considerations of PPP loan forgiveness. First, for the tax treatment of the PPP loan forgiveness: when Congress enacted the CARES stimulus legislation at the onset of the pandemic, it specified that the income generated from PPP loan forgiveness would not be recognized as income for tax purposes. Shortly thereafter, the IRS announced that since this debt forgiveness income would not be taxable, the expenses incurred related to this tax-exempt income would not be deductible, too.

Thus, for financial statement purposes, a PPP borrower will realize income when your loan is forgiven and the related expense you incur with the PPP funds is expensed. If the PPP loan is fully forgiven, the income and expenses will produce zero net income. For tax purposes, the forgiveness of the PPP loan produces no income, but the expenses are nondeductible, and this will also result in zero net income.

When all the dust settles on the PPP loan forgiveness, the book and tax treatment of the debt relief income and related expenses will be the same. This being said, there may be a timing difference as to when these events occur for book and tax purposes, and these could be recognized over different fiscal years.

For the other items noted above that you might consider in the year the PPP loan is forgiven, they also have specific tax rules that apply. For instance, bad debts are generally deductible when the receivable is totally or partially worthless; no bad debt reserve method is permitted. Also, for inventory write-downs, the inventory generally needs to be sold or disposed of to be written off for a tax deduction, and reserves for obsolescence are not allowed. As borrowers look at these various items, you need to also explore what the corresponding tax provisions are for them.

Please see the below illustration for an example:

Our dedicated team of manufacturing industry experts is available to support you and your business during this unique time. If you have questions about PPP loan forgiveness, please contact our professionals.

About our authors

Sylesh Babu

Sylesh Babu, CPA, CFE, ACA, DipIFR, is a partner in the company’s audit and assurance practice. Sylesh has nearly 30 years of experience providing accounting and audit solutions, with extensive knowledge in addressing challenges facing clients in manufacturing & distribution, business and professional services industries such as engineering, law, staffing and IT consulting services. In his role, he offers financial statement audit, review and compilation services as well as agreed upon procedures, due diligence, forensic and consulting services to businesses.

Jim Brandenburg

Jim Brandenburg, CPA, has extensive experience and knowledge in corporate and partnership tax law, mergers and acquisitions and tax legislation. His expertise includes working with owners of closely held businesses to identify tax planning opportunities and assist them in implementing these strategies.