This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Revenue Recognition – An example of an automated approach in D365 for Finance and Operations: Part 2

The previous blog defined the setup steps needed for an easy and automated revenue deferral and automated periodic recognition of revenue in Dynamics 365 for Finance and Operations (D365). This article will demonstrate one way (of many) that revenue deferral can be automated in D365FO. The Revenue Recognition feature (available for all sales orders, including T&M project sales orders) can be set up for numerous scenarios based on the settings, configurations, and needs of the organization. It addresses the need to automatically defer/accrue revenue for a service or subscription type obligation or long term project obligations. As a reminder, the feature must be activated using the module’s “License key.”

Generate deferred revenue

1. Sales Order

1.1 Create a Sales Order

Create sales order with at least one released product defined for revenue recognition. There are two concepts to be considered for revenue recognition:

- Determine the revenue price – based on the setup of the released products.

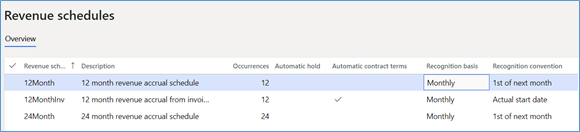

- Determine when revenue recognition should occur – based on the revenue schedule defined on the order line.

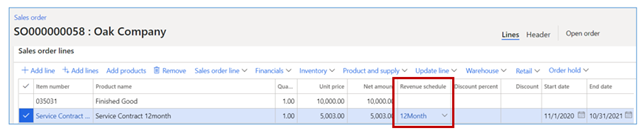

Line1 – Item # 035031 – not assigned to a revenue schedule. Revenue will be recognized as soon as the item is invoiced.

Line2 – Item # Service Contract 12mth – is a service item set up as a post contract support (PCS) item providing support over a 12-month period.

- Assigned a revenue schedule on order line 2

- “Contract” start and end dates must be defined for PCS items.

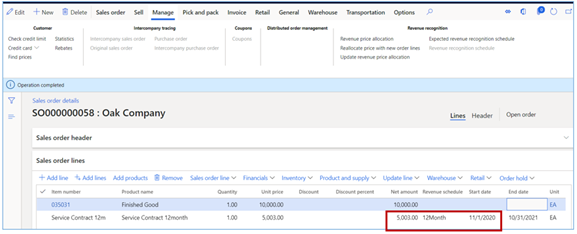

1.2 Confirm the sales order

Once the sales order is confirmed, the Revenue recognition buttons on the Manage Action Pane are available to review the Expected revenue recognition schedule.

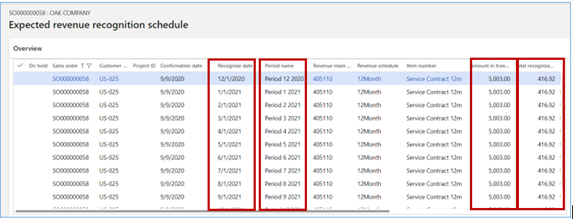

The revenue schedule uses the Revenue to recognize value as the amount that will be deferred. To keep this example simple, the sales price to the customer of $5003.00 will be deferred and spread evenly over the 12 periods.

1.3 Generate the invoice

Once the items on the order have been picked and packed, the final step is to invoice the order.

Looking at the ledger transactions generated by the invoice, we see the following:

| Customer AR | $15,003.00 | |

| Revenue | $10,000.00 | |

| Deferred Revenue | $5,003.00 |

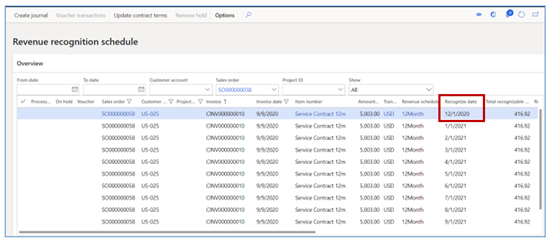

In this example, the revenue schedule begins on 12/01/2020 due to the setup of the released item Service Contract 12mth (Revenue schedule Recognition convention is 1st of next month) and the “Start date” on the sales order of 11/01/2020.

2. Period end process – post revenue for the month

2.1 Review revenue schedule transactions

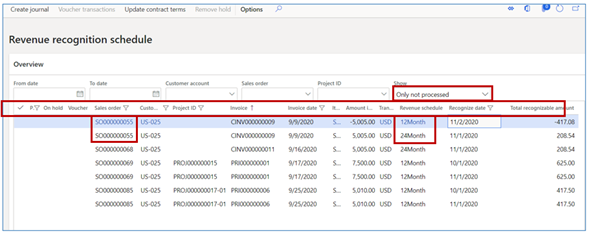

Each revenue schedule can be accessed from various forms (ex. directly from the invoiced sales order), however, the easiest way to access all details for period-end accruals, would be through the Periodic tasks > Revenue recognition schedule page. NOTE: Use column filters or the filters above the grid to define the criteria (date range, sales order, customer, project ID, or state) for the schedule details and reduce the number of records that are displayed.

The window below displays all “unprocessed” transactions thru 11/30/2020 (filtered with Recognize date < 12/01/2020) and the amounts that are available to post to Revenue, including a re-allocation from a correction made to the revenue schedule of an invoiced order.

The following fields can be edited from this form:

- On-hold flag

- Recognize date

2.2 Recognize periodic revenue

From the Revenue recognition schedule page (above), select Create journal.

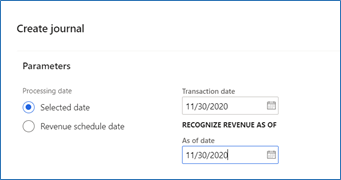

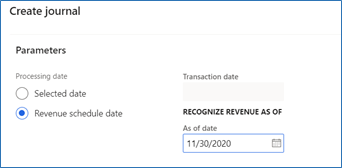

- Create Journal – Opens selection criteria dialog box.

- Select a Processing Date method

Using Selected date:

Transaction date = Date to apply to the Journal created

As of date = Unprocessed records through this date will be selected (if not on hold).

Using Revenue schedule date:

Transaction date = N/A (journal line dates will = transaction date on the schedule).

As of date = Unprocessed records through this date will be selected (if not on hold).

An informational message displaying the number of transactions that have been created and the journal number created. The journal is not automatically posted.

The schedule lines that were transferred to the journal are marked as Processed, indicating that the lines have been transferred to the journal.

After the revenue recognition journal is posted, the Processed flag remains.

If the revenue recognition journal or a line(s) is deleted, the Processed flag is removed.

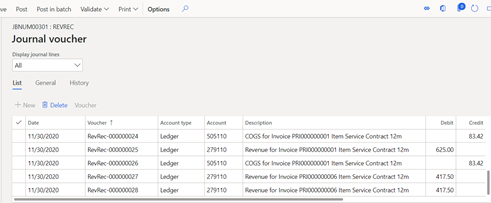

2.3 Review and post Journal

- Revenue recognition Journal form

- Open the revenue recognition journal menu item (Revenue recognition > Journal entries > Revenue recognition journal) and select the journal number displayed above.

- Select Lines to view the details of the journal. Revenue and COGS lines were created for the period(s) selected.

- Voucher number – will appear on the schedule when the journal is posted.

- Account column – deferred revenue ledger account (cannot be edited) that will be relieved.

- Offset account column – revenue ledger account (from Inventory posting profiles) and the financial dimensions (from the sales order line).

- Debit/Credit amount column – value is pulled from the line of the schedule (cannot be edited).

- Exchange Rate – the exchange rate is pulled from the invoice (if the sales order is multicurrency).

- Post Journal

Select POST on journal header or line screen.

With minimal setup, deferred revenue can automatically be calculated, processed, and periodically posted for the life of the invoice line’s recognition schedule.

Have any questions about automated revenue deferral in D365FO? Please contact us at any time.

This publication contains general information only and Sikich is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or any other professional advice or services. This publication is not a substitute for such professional advice or services, nor should you use it as a basis for any decision, action or omission that may affect you or your business. Before making any decision, taking any action or omitting an action that may affect you or your business, you should consult a qualified professional advisor. In addition, this publication may contain certain content generated by an artificial intelligence (AI) language model. You acknowledge that Sikich shall not be responsible for any loss sustained by you or any person who relies on this publication.