Twenty for 20 (20-4-20)

On August 8, 2018 the IRS released its much anticipated proposed regulations under new Section 199A (the new 20% deduction for pass-through entities and sole proprietors). This is the deduction for “Qualified Business Income,” or “QBI” that was enacted as part of the “Tax Cuts and Jobs Act” last year. We covered these proposed regulations briefly when they were issued (please click here for our earlier article) and will take a more in-depth look at these proposed regulations in this article by exploring 20 selected provisions. This is our “Twenty for 20,” as we analyze twenty items in these proposed regulations to help you see clearly how this 20% deduction works.

Background

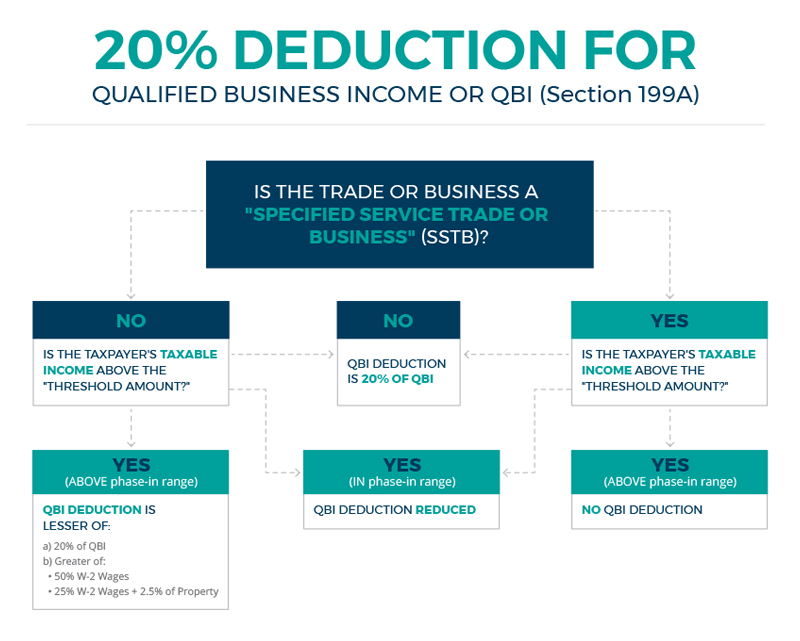

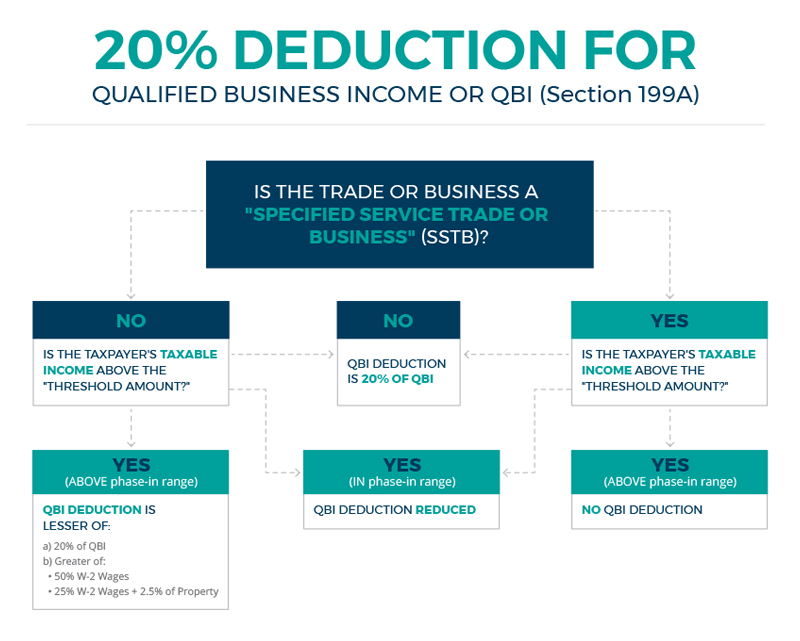

Congress enacted Section 199A to provide a deduction to non-corporate taxpayers of “up to” 20 percent of the taxpayer’s QBI from each of the taxpayer’s qualified trades or businesses, including those operated through a Partnership, S Corporation, or Sole Proprietorship. A deduction of up to 20 percent is also available for the taxpayer’s aggregate qualified REIT dividends and qualified publicly traded partnership income. The actual deduction is claimed at the individual or trust level. For each qualified trade or business, Section 199A limits the amount of this deduction to the lesser of 1 or 2 below:

- 20 percent of the taxpayer’s QBI with respect to the qualified trade or business; or

- The greater of:

- 50 percent of the W-2 wages with respect to the qualified trade or business; or

- The sum of 25 percent of the W-2 wages with respect to the qualified trade or business PLUS 2.5 percent of the unadjusted basis immediately after acquisition (UBIA) of all qualified property.

- There is also an overall limitation of 20% of taxable income (without the QBI deduction).

Section 199A also indicates that the QBI deduction is not available for an employee’s wages, guaranteed payments paid to partners, and for income from a “Specified Service Trade or Business (“SSTB”). Generally, the SSTB (as further described in the proposed regulations) are service type businesses. Even if income was earned from a SSTB, the deduction might be available if the taxpayer’s taxable income is less that an applicable threshold amount.

20 Selected Highlights in the Section 199A Proposed Regulations

The proposed regulations, including the preamble, run nearly 200 pages. The Section 199A statutory language was complicated and so are these proposed regulations, but they also help address many uncertainties and questions of this new provision. While there are still questions that remain, these proposed regulates are important and generally taxpayer-friendly and will help taxpayers and tax advisors understand and work with this new area of the tax law.

Before starting on our 20 for 20 list, a few definitions are in order. These three key definitions lay the groundwork for several Section 199A provisions. The following selected definitions were spelled out in the proposed regulations (and referenced throughout):

- SSTB – Specified Service Trade or Business. An SSTB is a trade or businesses that involves a service and is generally not eligible for the 20% QBI deduction. Please also see 10, 11, 12, and 13 for more on SSTB.

- UBIA – Unadjusted Basis Immediately After. This is the unadjusted basis of assets used in the trade or business immediately after the assets were acquired and used in the trade or business. This comes into play for the 2.5% cost element in the QBI formula. Please also refer to items 6, 7, 8, and 9 below.

- RPE – Relevant Pass-through Entity. An RPE is an S Corporation, Partnership, or Sole Proprietorship, that operates a trade of business and generates qualified business income.

space

1. Fiscal Year Impact. One of the uncertainties with this new Section 199A provision is when it would first be effective for fiscal year taxpayers. For instance, would the shareholders of an S Corporation with a September 30th fiscal year be entitled to the new 20% for the fiscal year ending 9/30/2018, and thus the 2018 year for the individuals? Or, would they need to wait until the FYE 9/30/2019 and the 2019 calendar year? The proposed regulations addressed this issue and made it clear that the deduction is available for fiscal year taxpayers for their tax year that ends in 2018. Thus, in the example above, the S Corporation with a September fiscal year would first be allowed the new 20% deduction for its FYE 9/30/2018. This treatment could be significant and impact the 2018 quarterly estimates and tax planning for any impacted shareholders of profitable fiscal year pass-through entities.

2. Rental Property as a Trade or Business for QBI Purposes. There was much discussion from taxpayers and tax practitioners as to whether a rental property would be treated as a trade or business for QBI purposes. The IRS addressed the matter of rentals in these regulations, however, they did not provide a definition of what constitutes a trade or business or a bright line test (i.e., some form of hours test). Instead, the IRS took the position that for QBI purposes, taxpayers would need to look to another part of the tax law, Section 162, and some of the tax cases, rulings and guidance dealing with what is a trade or business for Section 162 purposes. The Section 162 standard would then be used for QBI purposes. This, however, is still is a subjective approach, and perhaps the IRS will later provide a more specific indicator of when a rental should be treated as a trade or business for QBI purposes. In the meantime, the owner of the rental property should document the activities undertaken, time spent, amounts expended, etc. that it incurs each year in carrying out the rental activity. The more activity done (or arranged for) by the property owner for the rental property, the more likelihood of classification of the rental activity as a trade or business. On the other hand, a “triple net lease” type arrangement that requires little time and effort on the owner’s part would likely not rise to the level of a trade or business.

3. Rental Property Treated as Trade or Business – Exception for Self-Rental. The proposed regulations, however, do provide one important exception for the issue of whether a rental constitutes a trade or business for QBI purposes. If the property is rented to a related party (meeting a common control standard) and this related party is a trade or business for QBI purposes, then the rental property is also classified as a trade or business for QBI purposes. This is a favorable designation for a self-rental, and taxpayers should keep this in mind.

4. W-2 Wages – General. The W-2 wages paid by an employer are an important part of a taxpayer’s QBI deduction calculation when the taxpayer’s income exceeds the threshold amount. First, the W-2 wages must be properly allocable to the QBI of the taxpayer. Next, these W-2 wage limitations apply separately for each trade or business of the taxpayer (unless the aggregation election is made). Further, an RPE must determine the amount of W-2 wages and report these amounts to the owners of the RPE (likely to be included on the Schedule K-1 of the RPE). The proper allocation of wages to a partner can become complex when special profit and loss allocations are involved.

The IRS issued Notice 2018-64 at the same time the proposed regulations were issued. The notice indicates that the IRS will later issue a revenue procedure addressing three methods of calculating wages for QBI purposes.

5. W-2 Wages – PEO Payroll Providers. The proposed regulations provide that a taxpayer may consider any W-2 wages paid by another party and reported by the other party on Form W-2 by the taxpayer provided that the W-2 wages were paid to common law employees of the taxpayer for employment. This could include, for instance, wages paid by a certified PEO (Professional Employer Organization) to the employees of the business. The wages would be treated as paid by the employer business for QBI purposes, and not as QBI wages for the PEO. Further, it is important to note that qualified wages for QBI purposes are only allowed if the annual Form W-2s are filed by the employer or its agent (i.e., a PEO) on or before 60 days after the due date for filing these Form W-2s.

6. UBIA – General Comments. UBIA is a component of the second limitation of a company’s QBI (25% of the businesses Form W-2 wages plus 2.5% of the UBIA of its qualified property). “Qualified property” is described as depreciable tangible property that is held by and used in the trade or business at the end of the year and used in the producing QBI. In addition, 2.5% of UBIA applies only for the “depreciable period” of the depreciable property. This UBIA depreciable period is different from the tax life for tax depreciation purposes. The depreciable period generally begins when the property is first placed into service and ends on the later of: (1) ten years after the date it was placed into service; or (2) last day of the property’s tax “depreciation period”. The depreciable period for real property is 27½ years for residential real property; 39 years for commercial real estate; and 15 years for land improvements and other 15-year MACRS property. The proposed regulations indicate that even if 100% bonus depreciation (or Section 179 expensing) is taken on qualified property, it will not impact or reduce the property’s UBIA. Further, the term “immediately after acquisition” is defined as the date the property is placed in service by the trade or business. Therefore, in most cases, UBIA will represent the purchased cost of qualified property as of the date it is placed in service. Additional complicated rules apply in the case of like-kind exchanges or other transfers in non-recognition transactions, as well as for improvements to the property that are capitalized.

7. Planning Observation with UBIA and TPR. Some property additions or property improvements might be allowed to be directly expensed under the Tangible Property Regulations (“TPR,” or the “Repair Regs”) issued several years ago. By directly expensing these items, the taxpayer would not establish any UBIA for this expenditure as it was expensed and treated as a repair type item. If instead, the item was not expensed under the repair regs, but capitalized and then expensed under bonus depreciation or Section 179 provisions, then the taxpayer receives the same overall deduction, but also establishes some UBIA for Section 199A purposes.

8. UBIA – Partnership Considerations. First, for property contributed to a partnership, the UBIA will generally be the tax basis of the contributing partner. The depreciable period will be determined based upon when the property was originally placed in service by the contributing partner. Next, partnerships offer special basis adjustment rules when partners acquire an interest in a partnership, or the partnership redeems out a partner from the partnership. The IRS explained in the proposed regulations that these special partnership basis adjustments are not treated as new separate qualified property for UBIA purposes.

9. UBIA – Reporting Issues and Depreciable Period Schedules The RPE must determine and provide the UBIA to each of its owners so they can apply the above 25% wage and 2.5% basis limitation. The proposed regulations specify that the UBIA is allocated to the RPE owners in proportion to the way the owners share tax depreciation. Thus, if a partnership has special allocations, these allocations will be important in how the partnership’s UBIA is allocated. In addition, if the property is fully depreciated for tax depreciation purposes, but still has remaining life for its depreciation period (for UBIA purposes), then the UBIA is allocated to the owners based on how any gain on this property would be allocated if such property were sold.

Taxpayers and RPEs will now have another set of fixed asset records to maintain. They already have depreciation for book or financial statement purposes, as well as several options for tax purposes (federal, possibly AMT, and state). Now there is a new tax set of depreciation records needed for UBIA purposes which looks at the initial cost of the qualified property and then its applicable UBIA depreciation period.

10. SSTB – Reputation or Skill of One or More its Employees or Owners. The proposed regulations provided a taxpayer-friendly narrow view of this reputation or skill term as the IRS felt this is what Congress intended in Section 199A. The regulations restrict the meaning of the reputation or skill to situations in which the individual is involved in the trade or business of: (1) receiving income for endorsing products or services; (2) licensing or receiving income for use of an image of an individual, and this could include the likeness, name, signatures, voice, etc. dealing with an individual; and (3) receiving appearance fees or other income, including fees to reality performers performing as themselves on television, radio, or social media, etc.

11. SSTB – Insurance and Real Estate Agents and Brokers. The proposed regulations offered a mixed bag concerning brokerage services. Stock brokers and similar professionals dealing with securities and receiving a commission or fee were classified as being a SSTB. Real estate agents and brokers, insurance agents and brokers, however, are not designated as an SSTB.

12. SSTB – Financial Service Professionals and Bankers. “Financial services” are included as a SSTB. The proposed regulations describe financial services to cover financial advisers and investment bankers, wealth managers, and services involving valuations, mergers, etc. A significant exception, however, was carved out for bankers and those who make loans and take deposits, and thus these individuals and businesses will not be treated as a SSTB.

13. SSTB – Related Activities. There was concern that some SSTBs might split out administrative functions in order to generate business income eligible for the 20% deduction. The IRS saw this approach as an abuse, so it added a new limitation. The proposed regulations specify that a trade or business that has 50% or more common ownership with a SSTB and provides 80% or more property or services to the SSTB, the trade or business will be classified as a SSTB. Further, if there is the same 50% common control, but less than 80% of property or service is provide to the SSTB, then the allocable amount of property or service is treated as a SSTB.

14. Trade or Business of Being an Employee – Impact on Former Employee. Section 199A and the proposed regulations state that the trade or business of performing services of an employee is not a trade or business for QBI purposes. Thus, no items of income from the trade or business of being an employee will be classified as QBI.

15. Netting Process with Several Businesses – Net Overall Loss. Another issue needing clarification with this new 20% deduction for pass-through businesses is how to handle several trades or businesses if some generate income and others generate losses. If the QBI income or loss from all the trades or business result is a net loss, this net loss carries over to the subsequent year(s) for the taxpayer. Further, with an overall net loss, there is no 20% deduction available to the taxpayer for the year. If some qualified trades or businesses have losses, but net overall income exists, the losses from the trade or businesses are allocated proportionately against the income of the profitable businesses. In addition, the wages and UBIA of the loss activities is not considered in determining the QBI deduction.

16. Netting Process with Several Businesses – Net Overall Income. Next, if the combination of all trades or business results in net overall income, then a different approach must be followed. First, the taxpayer must reduce the businesses that generated income for the year by the businesses that incurred a loss for the year. Second, the total loss from the businesses with losses is allocated to each business generating income from the year on a proportionate basis. Finally, the businesses with income, take their qualified business income and reduce it by the allocable losses, and then apply the general formula with the 50% wage and 25% wage plus 2.5% property provisions.

17. Aggregation of Trade or Businesses. There was uncertainty on what to do with taxpayers who own and invest in multiple businesses – would the grouping provisions of activities under the passive loss rules apply, or something else? The IRS determined that the passive loss rules which are based upon “activities” were not similar with the provisions for the new 20% deduction for qualified business income which are determined based upon trade or businesses. The IRS, however, felt some form of grouping should be available to taxpayers on an elective basis if certain requirements are met. In order to group businesses, the following items must apply:

- Each trade or business must be a qualified trade or business.

- The same person or group of persons must own directly or indirectly a majority interest in each of the trades or businesses.

- None of the businesses are classified as a SSTB.

- Finally, the taxpayer must establish that the business satisfies two of the following three factors:

space

- The businesses provide similar products or services that are often provided together;

- The businesses share facilities or centralized business elements (accounting, HR, IT, etc.)

- The businesses are operated in cooperation with or reliance on other businesses in the aggregated group.

An individual owning these trades or business (or through RPEs) can “elect” to aggregate these businesses and thus the above calculations are done with the combined businesses, not separately. Further, the proposed regulations state the businesses that are aggregated must be disclosed by the taxpayer in their tax returns and consistently followed in subsequent years.

18. More on Aggregation. The election to aggregate businesses is made at the individual, not entity level. An election by one owner does not impact the election other owners. An individual owning these trades or business (or through RPEs) can elect to aggregate these businesses and thus the above calculations are done with the combined businesses, not separately. Further, the proposed regulations state the businesses that are aggregated must be disclosed by the taxpayer in their tax returns and consistently followed in subsequent years.

19. Section 1231 Gains and Losses. Short-term capital gains and losses, and long-term capital gains and losses are excluded from the definition of QBI. This treatment was clear in the statute; however, Congress did not offer any direction as to what to do with Section 1231 gains or losses. For QBI purposes, the IRS took the position that any Section 1231 gains that end up being taxed as a long-term capital gains are not treated as QBI. This could reduce the amount of the overall 20% deduction. The IRS also stated that any net Section 1231 loss a taxpayer incurs is treated as QBI, and thus offsets other QBI generated by the taxpayer.

20. Complexity of Section 199A and Corresponding Regulations. In the preamble to these proposed regulations, the IRS estimates that taxpayers and tax practitioners will spend 25 million hours per year in dealing with compliance matters involving Section 199A. One of the more difficult aspects of QBI is how to calculate the deduction when the taxpayer’s taxable income is above the threshold amount and in the phase-out range. There are two phase-out provisions that could apply: (1) one involving the taxable income for the taxpayer and the two wage limitations, and (2) the other if the taxpayer is involved with a SSTB. When both phase-out provisions exist, it is a mind-numbing calculation, and the proposed regulations explain this and offer several examples illustrating how the calculation is done.

Please keep in mind, these proposed regulations are not final yet. The IRS requested comments on the proposed regulations and they plan on holding hearings to address various Section 199A matters. Further, the Staff of the Joint Committee on Taxation (“JCT”) in Congress is working on its “General Explanation” of the Act enacted last year, and this report will offer further insights as to what Congress intended with Section 199A when adopted last year. If the explanations for Section 199A in this report differ from the proposed regulations, the IRS may revise these regulations before they are finalized. The IRS hopes to finalize these QBI regulations before the end of 2018 so that taxpayers can rely on them in preparing and filing tax returns for the 2018 year.

* * * * *

Summary. The proposed regulations for this new 20% deduction with Qualified Business Income offer taxpayers and tax practitioners some much needed guidance with how to apply these new rules. The above 20 items should help get you started in identifying tax savings opportunities with your trade or business. But there are perhaps 20 more ideas that might apply in various situations. These rules are not final yet, but they do go a long way toward helping determine how taxpayers will be impacted and what they might want to consider. Please contact your Sikich tax advisor with any assistance you need with QBI, or if you have any questions.