Tailored Plans to Help you Manage and Mitigate Risks

For all of the hard work you have put into accumulating, preserving and ultimately distributing your wealth, you deserve a solid plan and steadfast peace of mind in knowing your income and assets are protected. Sikich offers a range of insurance services to help you meet your financial goals, safeguard your wealth and protect your assets in a variety of circumstances. We are one of the only firms to provide an independent, unbiased assessment of your insurance plan for you, free of charge. We’re always here when you need us and will continuously reassess your plan to ensure you are getting the best coverage for the best rate as time goes on. This is how we’ve built client relationships that span decades, and client loyalty that spans generations.

Your Insurance Options

Life

Make sure your family can meet important financial needs after your death.

Provide tax-free cash when cash is needed, pay off existing debts, replace lost salary, pay estate capital gains and income taxes, equalize inheritance, provide cash to transfer a business interest.

Disability

Maintain your standard of living in the event that you cannot perform your job.

Appropriately protect your own occupation specialty, ensure the correct supplemental benefits are included in your plan, properly protect your full income with group and individual coverage integration.

Long-Term Care

Safeguard your finance and independence in case long-term care is necessary.

Protect your income and your assets, maintain personal independence, prevent additional strains and protect your health care choices.

Thoughtful, Tailored Solutions from Insurance Experts

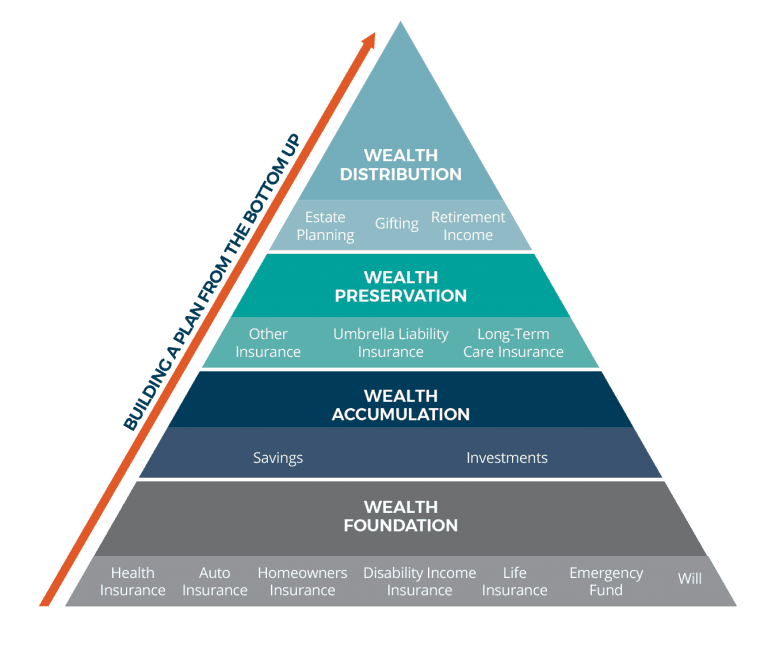

Insurance services from Sikich are more than just products and packages. Our experts offer a level of experience and understanding when it comes to the challenges you face and the concerns you must address. We’ll help you build a plan from the bottom up. Request an independent, unbiased review of your current plan today.

Discover the right plan for your unique situation

What’s the Advantage of a Full-Service Approach?

Backed by the resources of a full-service public accounting and consulting firm, Sikich insurance services have allowed clients to save thousands of dollars per year in premium payments, eliminate all premium payments while providing guaranteed coverage for life, or realize reduced premiums for the same level of protection.

What is a Life Insurance Review?

A life insurance review is not a life insurance replacement program. Instead, it is part of an ongoing assessment of your ever-changing needs. The focus of a life insurance review consists of analyzing your existing life insurance to determine if it is appropriate for your needs and also to determine whether the type and performance of your existing life insurance will still protect and meet your financial goals and objectives.

Why Do a Life Insurance Review?

Whether life insurance is needed to protect your family, fund an estate tax bill, complete an employee benefit plan or more, it is often central to helping you meet your financial goals and objectives. Just as your financial goals and assets change over time, your life insurance needs also change over the years.

How Much is Enough?

When determining how much insurance is needed to protect your family if something were to happen, many experts offer general rules on how much coverage would be needed. But remember, every family has its own special needs. So much depends on your age, whether you have children, what you earn, what your spouse earns and how much money you have saved. Also important are the amount, type and duration of your obligations—home mortgage, college tuition, as well as other loans and obligations.